SoftBank LatAm sees past recent losses, remains bullish on region

Reading Time: 3 minutesWhen SoftBank announced in 2019 that it had allocated $5 billion to investing in Latin American startups, it felt like an inflection point for the region.

And then when the Japanese investment conglomerate announced it had committed another $3 billion to startups there, it was only further validation that Latin America was home to a formidable startup system.

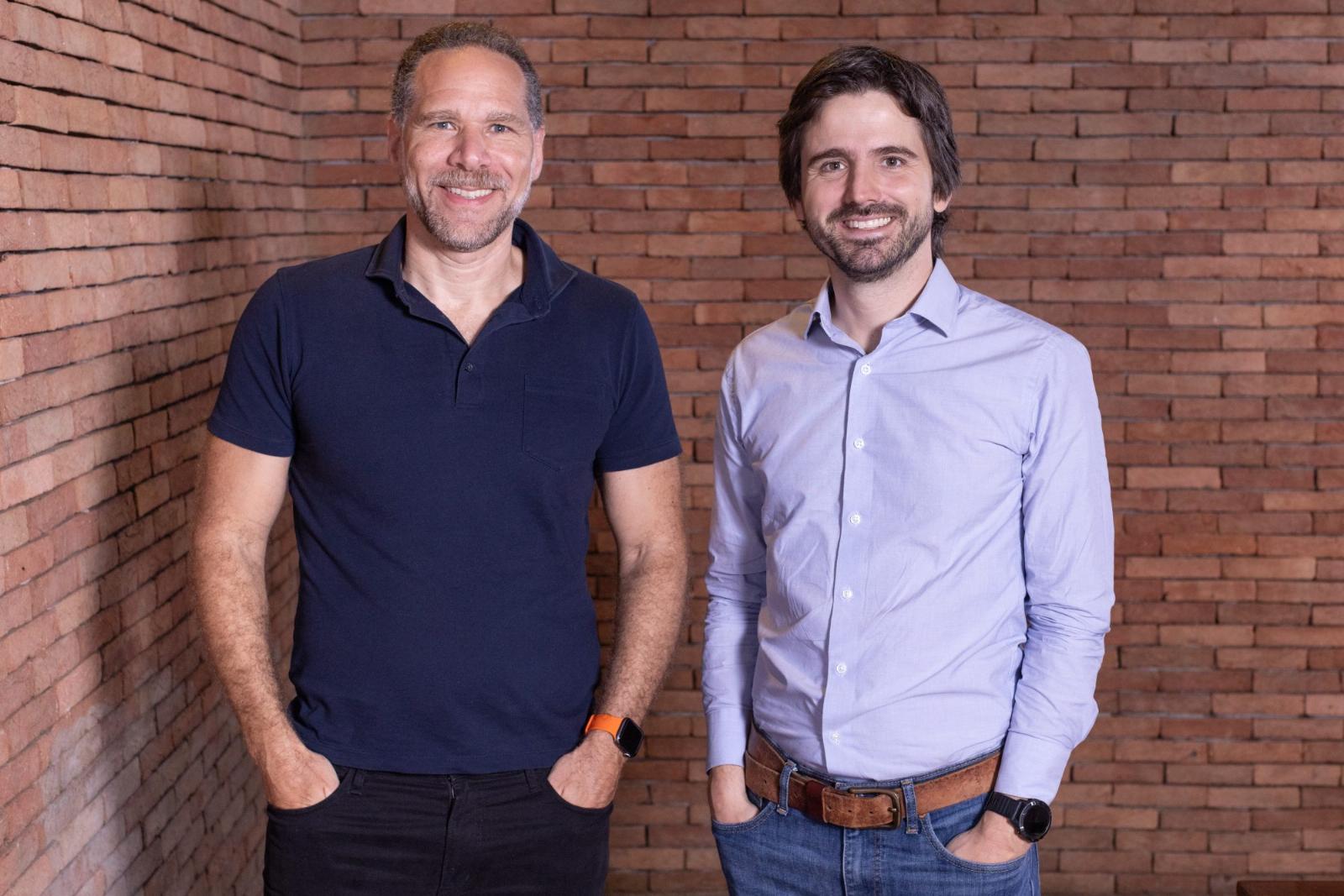

About $7.6 billion of that capital has been allocated across more than 80 investments, according to Juan Franck, managing partner of the SoftBank Latin America Funds. This means that SoftBank still has $400 million to back companies across LatAm, with about 50% of that money going to new investments and the other half going to existing portfolio companies.

Despite the fact that the total fair value of those investments was $6.4 billion at the end of 2022, the Latin America Fund’s managing partners say they are bullish on continuing to deploy capital in the region.

‘We continue to be extremely excited about the opportunities in LatAm,’ said Alex Szapiro, managing partner of the funds, in an interview. ‘It is very early still where we are with our fund.’

The pair remain optimistic despite the fact that in February, SoftBank Group’s investment vehicles — including its Latin America fund — posted a loss of $5.8 billion in the quarter that ended in December 2022 as the Japanese tech investor continues to bleed through the market downturn and significantly pares back new backings.

That marked the fourth straight quarter in which SoftBank Group has reported losing money.

Competitive edge

The duo believe that SoftBank, despite its losses, has a competitive advantage over other global investors putting money into LatAm startups in that it has members of its investment team working in various parts of the region such as Brazil, Mexico and Miami. (This makes sense considering that about 80% of its investment dollars in the region have gone to Brazilian and Mexican startups.)

‘From 2019 to 2021, a lot of players came into the region, but when the markets got a little bit shaky, those tourist funds left,’ Szapiro said. ‘We believe you need to have someone on the ground…Also, we understand the entrepreneurs in the market.’

In Latin America, where founders seek relationships just as much as they do capital, SoftBank hopes to capitalize on having an investment team that hails from the very regions in which it’s seeking to invest.

‘Many are first time-founders and it’s their first time going to venture and they rely on us for much more beyond capital,’ Szapiro said. ‘So we help them on the legal and HR side and with things like product development and marketing. We have teams in those areas, and they rely on us helping a lot.’

For Franck, that’s where SoftBank’s ‘long-term commitment comes to bear,’ especially as the startup world faces a downturn globally and capital is not nearly as easy to come by.

Over time, SoftBank has seen a few exits in the region, including Itaú, Brazil’s largest private bank, acquiring 35% of Avenue; Paystand, a U.S.-focused B2B payments network, acquiring100% of Yaydoo and Brazilian edtech giant Arco Educação acquiring 75% of Isaac in an all-stock deal. Other companies it has backed include Creditas, Kavak, Inter, VTEX, QuintoAndar and Rappi.

Of course SoftBank is not the only firm with people on the ground aimed at backing and/or helping startups in the region. For example, Kaszek earlier this week announced it had closed on $975 million across two new funds to back startups in the region. And last year, Latitud raised $11.5 million in seed funding from investors such as Andreessen Horowitz and NFX toward its effort to become ‘the operating system for every venture-backed company in LatAm.’

In recent years, SoftBank has also backed companies in other countries, such as Chile and Colombia, for example. And it plans to continue to do so.

‘Good opportunities transcend geographical barriers,’ Franck said. ‘And so we don’t spend too much time thinking about the country we are concentrating on.’

Overall, the pair concede that while investment pace slowed in 2022 as many venture firms were essentially ‘on lockdown,’ the demand for capital is also down — particularly in LatAm, where founders have historically been forced to be more disciplined than their U.S. counterparts because it’s generally more difficult to raise venture money there.

‘There is a lot of dry powder but I would say that funds in general are being much more disciplined on business models and valuations of companies,’ Franck said. ‘At the same time, a lot of the companies in our portfolio and across the region still have the cash on the balance sheet that they raised in 2021 and 2022. So that gives them the flexibility to actually continue to use that cash in a context of optimization and cash runway extension, and to not actually have to come to market in the short to medium term, especially in a market where the context would potentially demand terms that they aren’t willing to accept.’

Ref: techcrunch

MediaDownloader.net -> Free Online Video Downloader, Download Any Video From YouTube, VK, Vimeo, Twitter, Twitch, Tumblr, Tiktok, Telegram, TED, Streamable, Soundcloud, Snapchat, Share, Rumble, Reddit, PuhuTV, Pinterest, Periscope, Ok.ru, MxTakatak, Mixcloud, Mashable, LinkedIn, Likee, Kwai, Izlesene, Instagram, Imgur, IMDB, Ifunny, Gaana, Flickr, Febspot, Facebook, ESPN, Douyin, Dailymotion, Buzzfeed, BluTV, Blogger, Bitchute, Bilibili, Bandcamp, Akıllı, 9GAG