Remind Me, What Exactly Is SBF Charged With?

Reading Time: 4 minutesA guide to his seven (for now) alleged sins., Sam Bankman-Fried trial: Remind me, what’s SBF charged with?

This is part of MediaDownloader’s daily coverage of the intricacies and intrigues of the Sam Bankman-Fried trial, from the consequential to the absurd. Sign up for the MediaDownloaderst to get our latest updates on the trial and the state of the tech industry—and the rest of the day’s top stories—and support our work when you join MediaDownloader Plus.

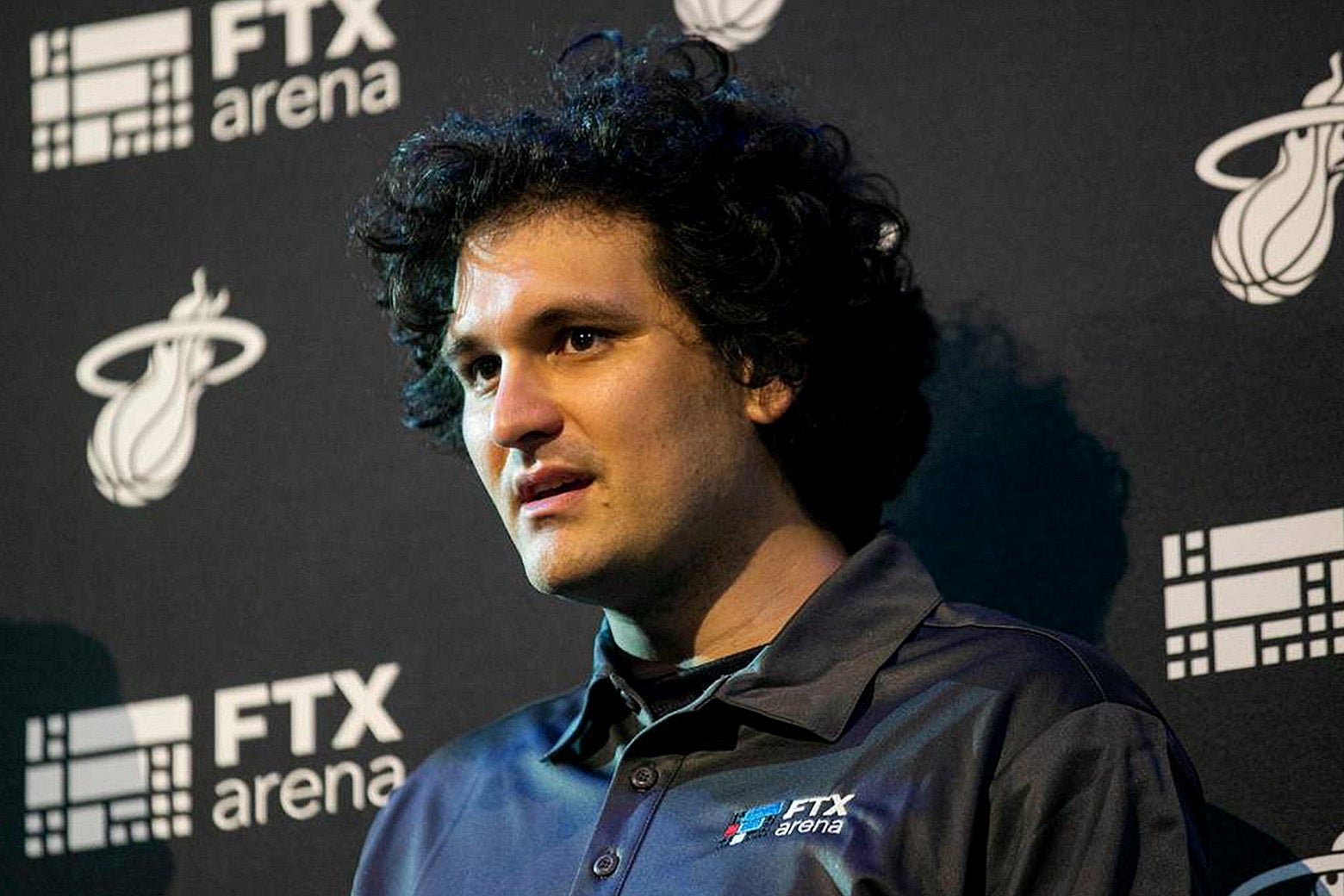

This week, fallen crypto superstar Sam Bankman-Fried goes on trial in federal court in Manhattan, just a mile or so from the offices of some of the many Wall Street powerhouses that his now-defunct company owes money to. The collapse of FTX, a crypto futures exchange, can seem quite abstract to those of us who never attempted to buy or sell digital currency through the platform.

But for the 1 million or so customers who lost money there, the next six weeks are bound to feel personal. FTX wasn’t some seedy gambling app for crypto bros. No no. It was supposed to be a respectable investment platform, the sort of place where a reputable tech company, media organization, government entity, or individual could strategically diversify with a little crypto. Convicting Bankman-Fried is not going to instantaneously restore billions back to frustrated customers’ accounts; separate bankruptcy proceedings will determine how money is recovered and allocated. But it would accomplish something rare in the world of financial crimes: sending the top boss to prison.

So what exactly does Bankman-Fried stand accused of beyond failing to keep his company afloat and publicly humiliating his colleague-slash-ex? This question has caused confusion. In July, prosecutors dropped a campaign finance charge, prompting many an incorrect social media report that they’d also dropped all other federal charges as well. The existence of several different types of legal proceedings involving Bankman-Fried, his associates, and the celebrities that promoted his exchange has furthered misunderstandings. The fact that his alleged crimes do not fit neatly into terms like ‘ponzi scheme’ does not help either. (Indeed, some legal analysts continue to insist that that’s a fair way to characterize what seems to have happened here, but it’s not what he’s been formally charged with.)

Marc Litt, a former federal prosecutor who tried Bernie Madoff, put the government’s case against SBF in helpfully simple terms for the CoinDesk podcast. ‘The government is alleging that promises were made to investors and promises were broken.’ By allegedly taking money from the clients of one business, FTX, and surreptitiously moving it into the pockets of his separate hedge fund, Alameda Research, he committed ‘fraud, in a wrapper of cryptocurrency.’

More specifically, Bankman-Fried is facing seven charges that fall into three main categories: wire fraud, conspiracy to commit fraud of many types, and conspiracy to commit money laundering. Bankman-Fried has pleaded not guilty. Opening arguments in the trial are expected to take place Wednesday. Here’s exactly what you need to know about the charges.

The prosecution will attempt to prove that SBF knowingly knowingly defrauded customers by taking money from FTX users and inappropriately allowing his hedge fund Alameda Research to use it to make risky bets, cover debts and apply it towards extravagant purchases. My colleague Alex Kirschner nicely summed up those risks in a piece earlier this week: Alameda ‘made speculative bets with unassuming depositors’ deposits. That hedge fund invested a lot of the money in made-up crypto tokens that were not just minted by FTX, but whose value was tied directly to confidence in FTX’s continued operation and success.’ When confidence in FTX plummeted, the equivalent of a bank run occurred and FTX was unable to pay its customers back. It soon declared bankruptcy.

Many have suggested that putting SBF in prison for doing this will pivot on proving that he intentionally created a backdoor in FTX’s code that enabled the flow of money between his two companies. Indeed, if prosecutors can prove this, that may sink him. But it may not be necessary, Martin Auerbach, a former federal prosecutor who has represented clients in many high-profile white collar crime cases, told me.

‘Wire fraud’ means that ‘you knowingly and intentionally defrauded people,’ he said, ‘and in the course of doing that you used the wire’—a phone, the internet, and so on. In order to prove fraud, prosecutors simply need to show that money was not being handled in the way clients had been told it would be.

SBF is facing an array of fraud conspiracy charges: two charges of conspiracy to commit wire fraud, one charge of conspiracy to commit commodities fraud, and one charge of conspiracy to commit securities fraud. What they all have in common is that they are conspiracy charges, not out-right fraud charges. These are easier to prove. Still, to fit the criteria, a person has to do more than talk about it with friends.

To convict SBF on any one of these conspiracy charges, the prosecution will have to convince the jury that SBF took a concrete step toward committing the specific type of fraud. Examples of concrete steps might be sending out an email containing inaccurate financial statements or creating misleading marketing materials.

Get ready for a lot of finger-pointing. As you may know, several of SBF’s colleagues, including top FTX executives and Caroline Ellison, the former head of Alameda Research and his on-and-off girlfriend, have already pleaded guilty to a number of fraud and money-laundering charges. Even before the trial, SBF and his lawyers began trying to claim that he had no idea what his colleagues were up to.

U.S. prosecutors will also try to prove that Bankman-Fried took steps intended to disguise the origins of money, taken from customers, that he later misleadingly used for all kinds of shady things. No, ‘shady’ is not legal lingo, but convincing the jury that he was not only engaging in unconventional financial engineering but that he was strategically deceptive will likely matter. Though Bankman-Fried no longer faces explicit election-law charges, this is where politics are still going to emerge. The prosecution will try to show that the fallen crypto mogul used customers’ money to donate to U.S. political campaigns in a way that intentionally concealed the true source of the funds.

In order to be convicted of any one charge, the prosecution will need to convince all 12 jury members. If he’s cleared, it’s not over yet. He’s still facing other civil and criminal charges.

Ref: slate

MediaDownloader.net -> Free Online Video Downloader, Download Any Video From YouTube, VK, Vimeo, Twitter, Twitch, Tumblr, Tiktok, Telegram, TED, Streamable, Soundcloud, Snapchat, Share, Rumble, Reddit, PuhuTV, Pinterest, Periscope, Ok.ru, MxTakatak, Mixcloud, Mashable, LinkedIn, Likee, Kwai, Izlesene, Instagram, Imgur, IMDB, Ifunny, Gaana, Flickr, Febspot, Facebook, ESPN, Douyin, Dailymotion, Buzzfeed, BluTV, Blogger, Bitchute, Bilibili, Bandcamp, Akıllı, 9GAG