New study of unicorn founders finds most are ‘underdogs,’ and female founders are rising

Reading Time: 4 minutesA new study that zeros-in on the founders of so-called ‘Unicorns’ (companies worth over a billion dollars) has found most have ‘underdog’ founders, are often drawn from the top 10 universities, a rising female founder make-up, but no obvious monopoly at Seed stage of funding for VCs.

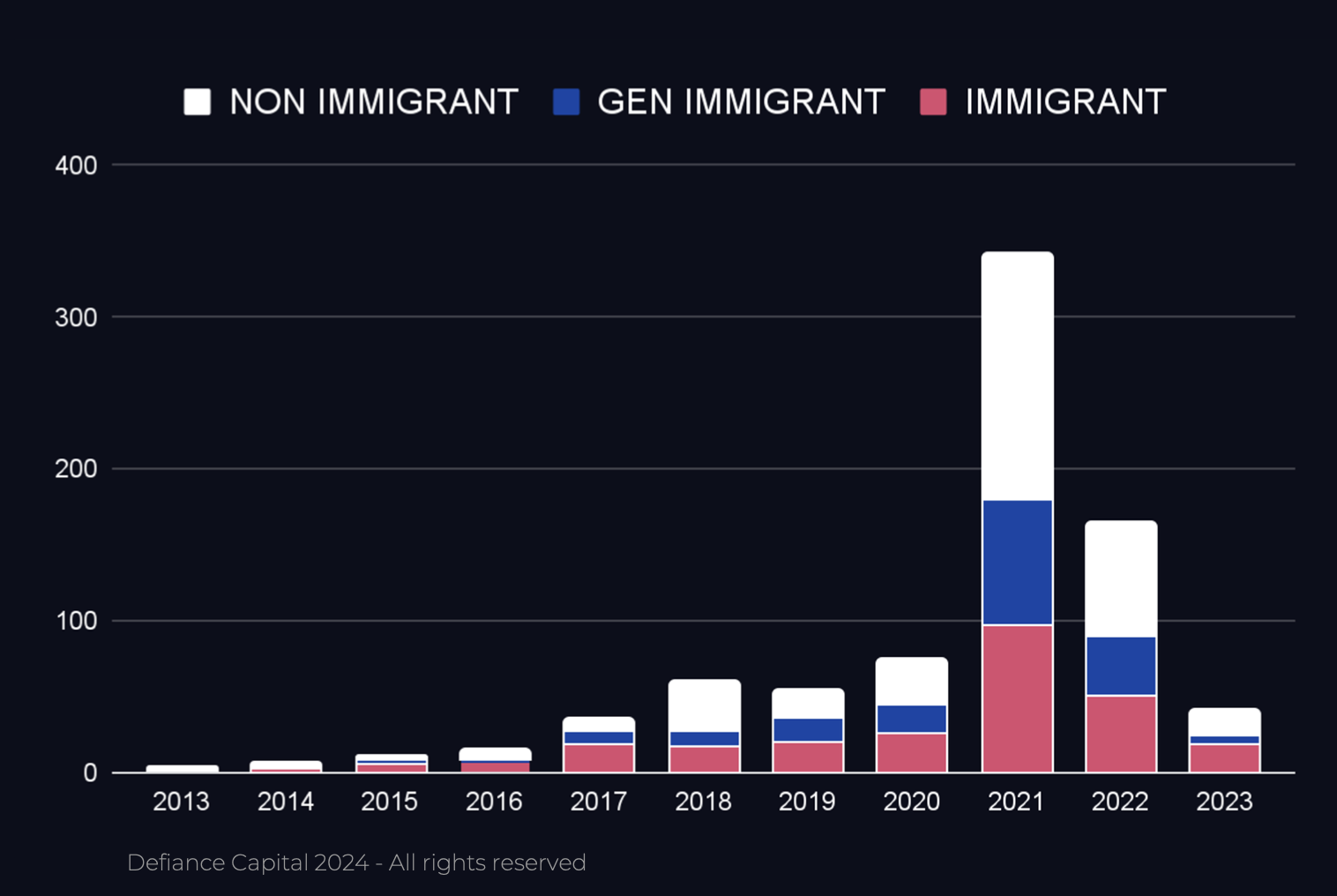

The study (‘Unicorn Founder DNA Report) by Defiance Capital of 845 unicorns and 2,018 unicorn founders set out to look at the ‘DNA’ of unicorn founders, concentrating on the US and UK (no EU/European) from 2013 to 2023, to define the common traits of these kinds of founders.

The study found:

• 70% of unicorns have ‘underdog founders’ (immigrants, women, people of colour).

• Unicorns used to have only male founders, but this is changing with 17% having a female founder in 2023.

• 53% have degrees from the top 10 global universities.

• 49% of unicorn CEOs had STEM degrees (64% of female founding CEOs had STEM degrees) and 70% of founder teams have STEM degrees.

• Outside of SV Angel (6.4%) and YC (10%), no other VC fund got into more than 2.8% (Sequoia) of unicorns. This suggests the market to invest in a potential unicorn is completely fragmented at Seed, meaning outlier VC funds have as much chance as a well-known fund to invest in a unicorn at the earliest stages.

The study further found that unicorns were dominated by white founders, but that every third unicorn had an Asian founder. Indeed, 38% of unicorns had at least one founder who was not white: 82% had at least one white founder, 62% had 1st or 2nd generation immigrant founders. Only 3% of unicorns had a black founder.

And only 21% of immigrant and female founders raised from top ten VCs. Teams with female founders were two years younger than all-male teams when founding their unicorns (32 vs 34).

Serial founders (50%) were more likely to succeed building unicorns, but only 1 in five unicorns had solo founders.

During the last decade, all top Seed funds were generalist funds, and the market for Seed funds is highly fragmented. Only 28% had raised capital from a top VC seed fund (with more than 1% market share).

Only 34% of unicorn founders had worked at an elite employer prior to founding a unicorn, suggesting a McKinsey or similar background is not a prerequisite to success.

The study also found three dominant factors in the ‘DNA’ of a unicorn founder.

1. No ‘plan B’

2. ‘A chip on the shoulder’

3. Unlimited self belief

The study found that many unicorn founders were forced to develop a growth mindset, with values, work ethic, and ambitions all established during childhood.

Most had a personal story of feeling unfairly treated or feeling limited in their native environment.

The study observed these traits in communities left behind for generations, e.g. women founders, people of colour, neurodivergent, or founders with atypical backgrounds.

Many tend also to be ‘ambitious rebels’, often motivated by a greater cause they care deeply about, have strong family role models, a quality peer network and no fear of failure.

A far greater number of 1st and 2nd generation immigrant CEOs had STEM degrees than local CEOs, suggesting a brain drain from emerging or smaller economies to developed ones. Significantly, more 2nd generation immigrants attended an elite university than the rest of the sample.

Other interesting data points came out of the study. Solo founders tended to start their unicorns three years later than founder teams, and it took 7 years on average to reach unicorn status for all types of founder teams, but 2nd generation immigrants took only 6 years.

And in fact, the all-white, male, local, Ivy league archetype of founder was actually an infrequent occurrence, at 11%, and only one third of founders native to a country where they founded the company graduated from a top ten university.

In addition, the top 20 US VC funds tended to favor male, immigrant founders with STEM degrees from elite universities at Seed, but appear to be missing a trick by largely ignoring female founders, a growing demographic in the unicorn space.

Commenting, Defiance Capital founder Christian Dorffer, told me: ‘I believe this is the most comprehensive study ever done on the backgrounds of unicorn founders in the US and UK. We cover all new unicorns from 2013-2023, covering over 2,000 founders and over 800 unicorns.’

‘VCs famously say that ‘it’s all about the people’, but with only 10% of unicorn founders fitting the Mark Zuckerberg profile, most of the thousands of Seed funds are backing the wrong type of founders. One interesting finding in our study is that even the best funds, like Sequoia, only get into less than 3% of unicorns – and only 30 funds have a unicorn market share of 1% or more,’ he said.

‘The hunger, self-belief, ingenuity and resilience we found in the unicorn founders also make a lot of sense when you see that 62% had immigrant founders (typically from countries where it’s impossible to build unicorns) and 17% of new unicorns last year had female founders.’

He continued: ‘Immigrants and other underrepresented founders are clearly able to produce these amazing results but I wanted to prove it to LPs. A lot of the immigrant founders are coming from the developing world, like India and Africa, even Eastern Europe. They don’t really have that many options at home. They have to leave and pursue opportunities elsewhere.’

‘There’s only 30 funds that have more than 1% share of all these unicorns, which means that it’s totally fragmented,’ he added.

‘If you combine this fragmentation with the fact that immigrants and women found it harder to fundraise, there’s a huge opportunity for new funds to come in and specifically set out to look for these founders.’

I asked him how a VC or a family office might change their strategy as a result of seeing this research?

‘Sequoia being the top fund in only 2.8% of unicorns means that they miss a lot. Yes, for LPs, top funds are a relatively safe investment. But family offices are now looking at emerging managers and especially early stage funds as the potential Alpha. So if you’re looking to maximise returns as a family office, you need to be in a few new funds, emerging managers in order to get that outlier company that turns into a unicorn,’ he said.

Dorffer, who intends now to produce a podcast with many of the unicorn founders surveyed, said: ‘The stories that are coming out show crazy determination. As a female founder, you have to work twice as hard and take twice as many meetings to raise the money. The founders of Andela and three African founders that built unicorns… have stories that are just so inspirational.’

Reference: https://techcrunch.com/2024/03/27/unicorn-founders/

Ref: techcrunch

MediaDownloader.net -> Free Online Video Downloader, Download Any Video From YouTube, VK, Vimeo, Twitter, Twitch, Tumblr, Tiktok, Telegram, TED, Streamable, Soundcloud, Snapchat, Share, Rumble, Reddit, PuhuTV, Pinterest, Periscope, Ok.ru, MxTakatak, Mixcloud, Mashable, LinkedIn, Likee, Kwai, Izlesene, Instagram, Imgur, IMDB, Ifunny, Gaana, Flickr, Febspot, Facebook, ESPN, Douyin, Dailymotion, Buzzfeed, BluTV, Blogger, Bitchute, Bilibili, Bandcamp, Akıllı, 9GAG