Level wants to back your fund — and your portfolio companies too

Reading Time: 3 minutesIn 2023, funds of funds (FoFs) are on track to raise the smallest amount of money in more than a decade. At the same time, muted venture deal activity has many firms ditching their follow-on funds. Despite these twin trends, a new emerging manager is looking to find success with a fund that targets both.

Level Ventures has raised $104 million for its debut fund, a data-driven, three-pronged investing strategy that uses in-house algorithms to back other emerging managers, invest in promising companies from those managers’ portfolios and source deals of its own.

He said that many family offices — his own included — were seeing strong returns by backing small and emerging VC funds and enjoying further success by co-investing alongside those firms in their portfolio companies. He decided to launch Level to see if that strategy could prove successful as an institutional investing approach when driven by data.

‘We wanted to disrupt the LP side of the equation,’ Azout said. ‘Most LPs, even fund of funds and institutions, tend to underutilize technology. We wanted to build something that was tech-enabled that allowed us to better understand the ecosystem.’

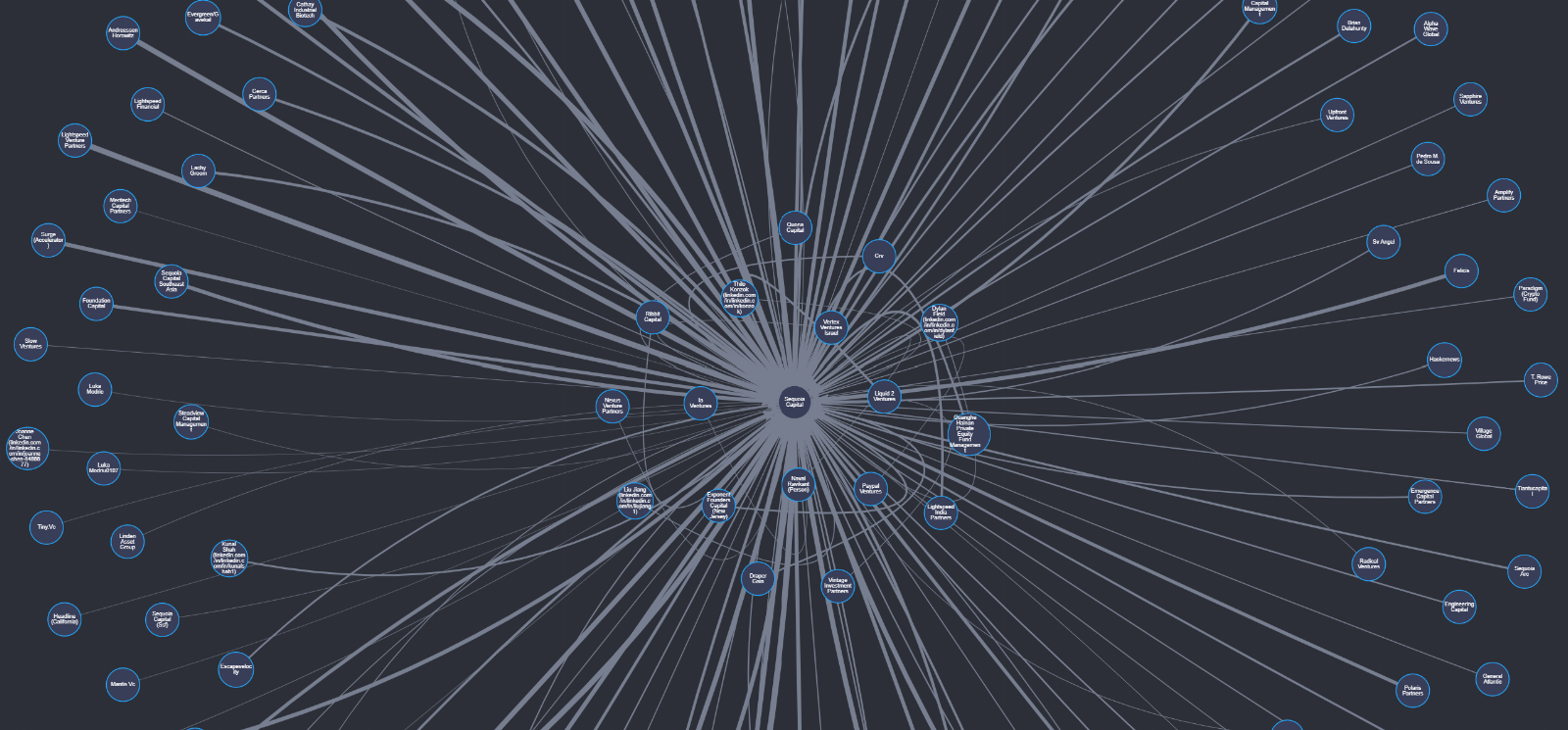

The first key to getting the strategy to work, Azout said, was finding the right fund managers. Level is targeting emerging managers focused on sectors including enterprise automation, deep tech and life sciences. Within those categories, the firm taps its in-house data model that scores firms based on areas like how many board seats a firms’ investors are on, who they are connected with online and where they are investing.

‘We spent a lot of time really making sure that our fund manager selection is optimal,’ Azout said. ‘A lot of the early iterations of the technology was building a model and approach that would yield the top quartile of managers. But the dispersion of performance across early-stage managers is very large. Trying to find the best funds is a moving target.’

The firm looks to back funds that are less than $150 million in size that are either pretty institutional — maybe on fund two or three — or are a solo GP who brings more than just capital to the table. So far, Level has backed firms including Air Street Capital, Emergent Ventures and Work-Bench.

From there, the firm looks to use its data capabilities to keep tabs on underlying portfolio companies to unearth which startups make sense for Level to invest in when they raise their next round. Level also gives its portfolio of funds access to the data it uses.

Level’s approach to build data solutions to source and find companies puts it squarely in line with trends that have begun to gain steam in venture. An increasing number of firms are looking to build algorithms to uncover deals they would have missed otherwise or that wouldn’t have crossed their radar.

‘We are seeing more and more firms adding automation and data to their sourcing process. It gives you alpha,’ he said. ‘If you don’t have data capabilities, you will be disadvantaged from a sourcing perspective.’

But the firm doesn’t 100% leave it up to the data. Azout said that while the data is great to narrow down the field, there is always a human in the loop, proving how much people drive this industry.

What makes Level distinct from the other firms looking to add data is that for the majority of its direct strategy, the data isn’t helping it cast a wider net to find a better set of companies. Rather it mainly helps it find the most successful startups from the investors they are already backing. While this does set the firm up to potentially get a double homerun if a company ends up as a notable success, it also means failures will be two-fold, at least for the companies it backs with its own funds.

The firm currently has an even mix of investments in both funds and companies, but for its second fund will skew that ratio 75% toward funds and 25% toward companies. For now, it hopes this strategy helps unlock the best of both fund and direct investing.

Ref: techcrunch

MediaDownloader.net -> Free Online Video Downloader, Download Any Video From YouTube, VK, Vimeo, Twitter, Twitch, Tumblr, Tiktok, Telegram, TED, Streamable, Soundcloud, Snapchat, Share, Rumble, Reddit, PuhuTV, Pinterest, Periscope, Ok.ru, MxTakatak, Mixcloud, Mashable, LinkedIn, Likee, Kwai, Izlesene, Instagram, Imgur, IMDB, Ifunny, Gaana, Flickr, Febspot, Facebook, ESPN, Douyin, Dailymotion, Buzzfeed, BluTV, Blogger, Bitchute, Bilibili, Bandcamp, Akıllı, 9GAG