HR startup Rippling is in discussions to raise at a $13.4B valuation, up from $11.25B

Reading Time: 2 minutesLate stage HRtech startup Rippling is raising new capital. The company’s new round, that has not yet closed, would inject $200 million into Rippling with another $670 million worth of shares being sold by existing stockholders, according to two people familiar with the deal.

This will be Rippling’s Series F, and could raise its valuation to as high as $13.4 billion on a post-money basis, up from the $11.25 billion valuation it reached when it last raised capital in a $500 million Series E just a year ago. Rippling had raised $1.2 billion total previous to this round.

Reached earlier today, a Rippling spokesperson declined to comment.

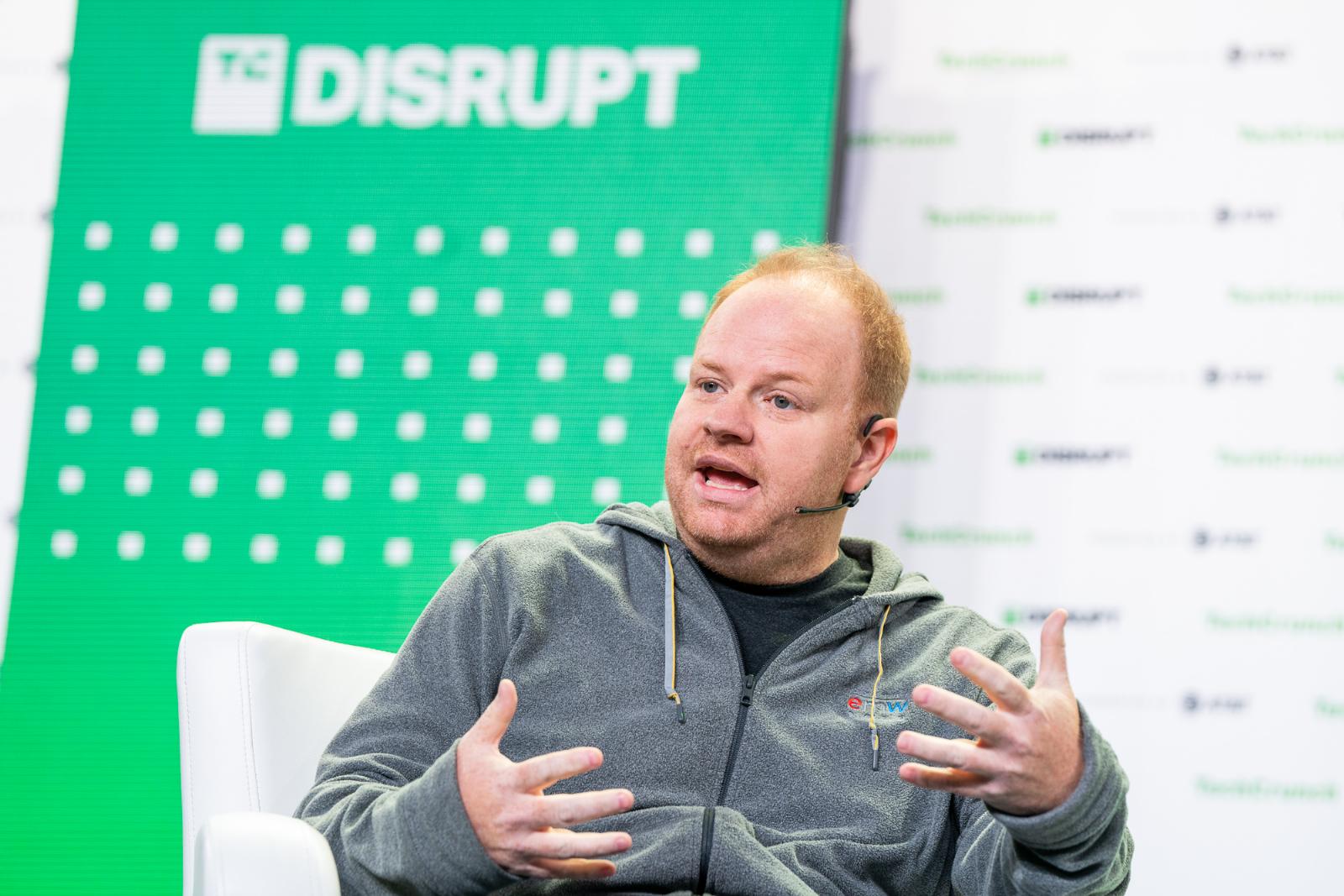

Rippling’s last round came together during the Silicon Valley Bank crisis, when Rippling’s funds were suddenly frozen. Rippling founder and CEO Parker Conrad took to X and worked the phones with his banks, investors, and its own customers to raise the cash needed to cover everyone’s payrolls.

In this round, existing investor Napolean Ta at Founders Fund is prepared to invest up to another $310 million, per two sources familiar with the transaction, which — very notably — would be the largest check that Founders Fund has ever written for a single company’s round. It’s unclear how much of this cash is for the new Series F shares and how much will be used to buy shares from other investors, because existing investor Coatue is actually leading the round. There’s participation from existing investor Greenoaks, as well.

With Gusto worth around $9.5 billion per Crunchbase data, Deel worth $12 billion, Remote more than $3 billion, and Rippling now at $13.5 billion, there’s a titanic amount of venture capital, founder and employee equity in HRtech today. And new companies are popping up, too. Remofirst recently raised $25 million, for example, to keep working on its low-cost hiring product that competes with many of the companies listed above.

Likewise, with the IPO market still sluggish, existing shareholders, be it employees or existing investors are also looking to sell stakes in private companies to gain liquidity. Large secondary transactions have become en vogue.

Ref: techcrunch

MediaDownloader.net -> Free Online Video Downloader, Download Any Video From YouTube, VK, Vimeo, Twitter, Twitch, Tumblr, Tiktok, Telegram, TED, Streamable, Soundcloud, Snapchat, Share, Rumble, Reddit, PuhuTV, Pinterest, Periscope, Ok.ru, MxTakatak, Mixcloud, Mashable, LinkedIn, Likee, Kwai, Izlesene, Instagram, Imgur, IMDB, Ifunny, Gaana, Flickr, Febspot, Facebook, ESPN, Douyin, Dailymotion, Buzzfeed, BluTV, Blogger, Bitchute, Bilibili, Bandcamp, Akıllı, 9GAG