The Caroline Ellison Show

Reading Time: 6 minutesSBF Tried to Blame Caroline Ellison for FTX. She Got Revenge on the Stand., The Sam Bankman-Fried trial’s most anticipated witness—his ex-girlfriend, his hand-picked hedge fund CEO—took the stand. Could she doom him?, Caroline Ellison testified at the SBF

This is part of MediaDownloader’s daily coverage of the intricacies and intrigues of the Sam Bankman-Fried trial, from the consequential to the absurd. Sign up for the MediaDownloaderst to get our latest updates on the trial and the state of the tech industry—and the rest of the day’s top stories—and support our work when you join MediaDownloader Plus.

Had Caroline Ellison been anybody other than The United States v. Samuel Bankman-Fried‘s single-most anticipated witness, she might have entered a Manhattan courthouse attracting fare less notice on Tuesday. But she’s Caroline Ellison—SBF’s ex-GF, the former CEO of his Alameda Research crypto hedge fund, one of the first from his inner circle to flip. So, despite masking her gray-coat-and-red-dress fit with a light-blue baseball cap, a pair of shades, and a backpack, Ellison was recognized immediately by the hungry media crews who’ve been encircling the Southern District of New York all month.

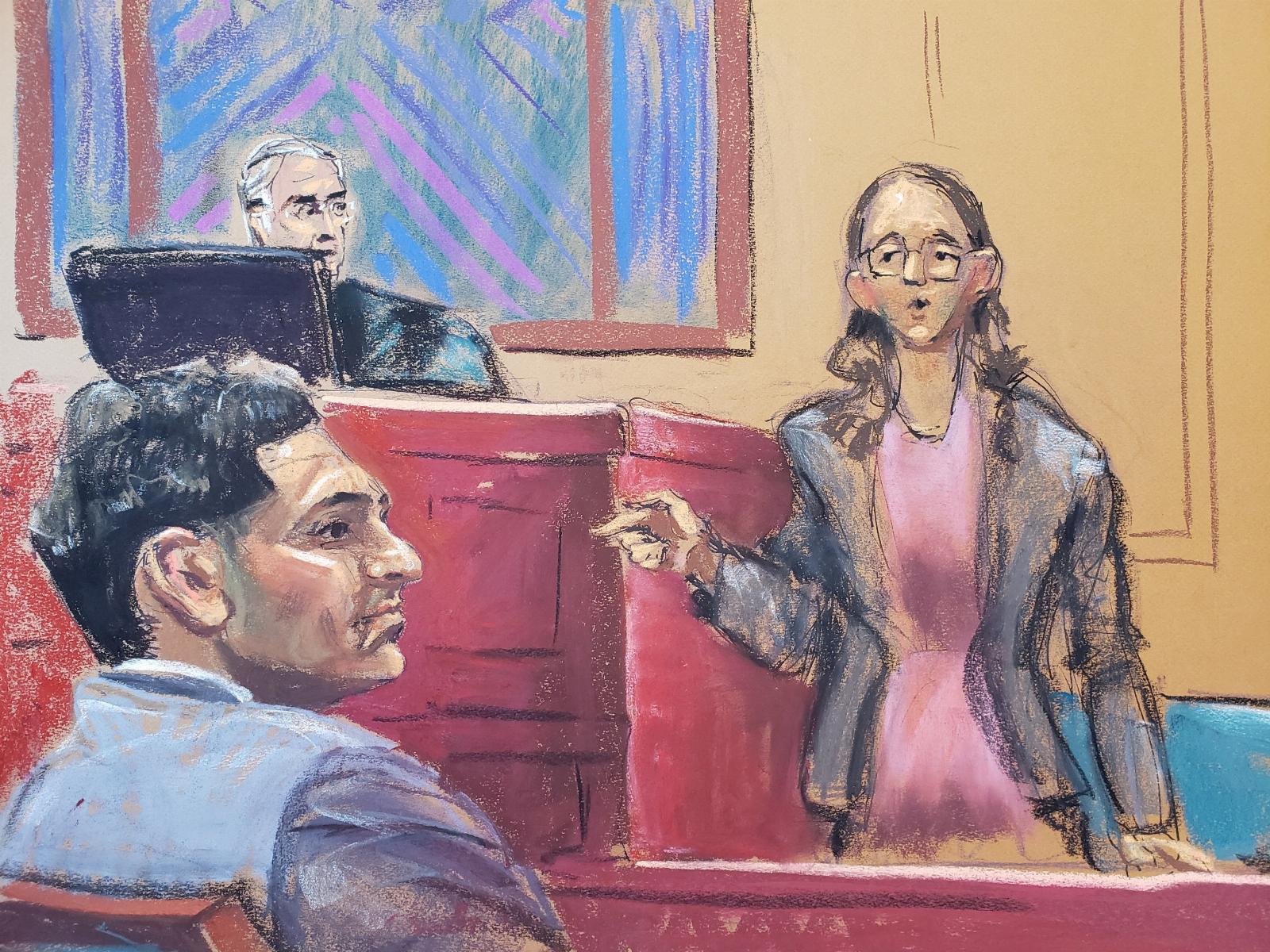

When Ellison took the witness stand in the late morning, following her former colleague Gary Wang, every single reporter in the media-overflow room hushed up. Right after she took the oath, the prosecutor asked her personally identify Sam Bankman-Fried; she stood up and spent a dramatic moment gazing across the courtroom, humming and moving her shoulders, yanking on her coat flaps, before finally pinpointing her former compatriot. You couldn’t blame her for taking a beat—SBF looks a lot different these days in that haircut and suit, and it’s likely Ellison hasn’t seen him since that fateful November week that crushed Bankman-Fried’s empire in a matter of days. And so began the Caroline Show.

In case you need a refresher: Caroline Ellison is the Stanford grad who met SBF while interning at Jane Street Capital, a prestigious quant-trading Wall Street firm, in 2017. Early the following year, as Bankman-Fried got Alameda Research off the ground, Ellison reached out, and SBF offered her an Alameda trading gig; she relocated to California for the opportunity. Over the next three years, as SBF & Co. bopped around from Cali to Hong Kong to their infamous Bahamian penthouse, Ellison, aka @CarolineCapital, was present for it all: the launch of the FTX crypto exchange in 2019, the rise of SBF as crypto megainfluencer, the increased prominence of the effective altruism movement to which she and SBF both subscribed, the balance-sheet leak and collapsed Binance-acquisition deal that doomed FTX and Alameda to bankruptcy. Ellison pleaded guilty in December to the charges Bankman-Fried faces now—wire fraud, money laundering, conspiracy counts for securities and commodities fraud—and agreed to cooperate with the Department of Justice’s investigation. All the while, Ellison became a figure of fascination, helping lend the whole affair a tabloid-y gloss. Observers pored over her old Tumblr blogs, her podcast appearances, and her private writings that Bankman-Fried leaked to the New York Times (an act that earned him an early trip to jail from the no-nonsense judge presiding over this case). For how omnipresent Ellison’s been in the saga, it was easy to forget that Tuesday marked her first public appearance all year.

So yeah, was every soul packed into the courthouse glued to Ellison’s testimony, which the prosecution has already predicted will run well into tomorrow? You bet! She admitted to doing crimes at Alameda with SBF and others, to defrauding her hedge fund’s lenders and FTX’s investors, to funneling billions of dollars (I swear I’ve never heard the word billion as often as I have in this trial, and I’m a legit fan of Showtime’s Billions) from FTX customers into Alameda accounts without due permission or disclosure, to making use of those funneled funds for inappropriate purposes, to cooking the Alameda books to cover these transfers, and to committing these misdeeds at the direction of Sam Bankman-Fried. All the while, Ellison’s long-awaited confessions were accompanied by jury displays of bizarrely arranged accounting spreadsheets, Google Docs dense with SBF input, and screenshots of private Signal chats (in which, among other things, Ellison informed an Alameda trader that Bankman-Fried got ‘upset at me when I spoke too openly’ about the sketchy crypto tabulations they were doing).

Not that, unfortunately for her, anything about Ellison is private anymore. She mentioned sleeping with SBF in the fall of 2018, the defendant’s parents in clear earshot, and responded to prosecution queries about how her on-and-off relationship with SBF affected their shared working environment. Ellison spoke clearly and confidently about crimes, passions, and crimes of (dis)passion, yet couldn’t help but to betray some of her (rather understandable) nerves: shifting in her seat, letting out a few long ‘ummms,’ giggling while asking Assistant U.S. Attorney Danielle Sassoon to repeat a question. It’s one thing to have so much of your private life exposed when you’re otherwise preparing to offer witness testimony; it’s another to go over it, in detail, in a room with many important people including your infamous ex, now sitting with arms scrunched at his laptop and wearing a stern expression.

Still, there may have been some quiet catharsis for Ellison on Tuesday. SBF spent much of his post-bankruptcy, pre-trial time talking a lot of shit about Ellison specifically, denigrating her Alameda leadership and essentially blaming her for his companies’ implosion. From Day 1, his defense lawyers have echoed that tack. The story Ellison laid out, however, revealed a much different tale, one in which she 1) was not sufficiently warned by SBF, upon joining Alameda Research in 2018, that the place was a dumpster fire in terms of business health and employee retention; 2) was also initially uninformed that Alameda had a sizable credit line that granted it the ability to withdraw customer FTX deposits nonstop; 3) repeatedly expressed concerns about financial holes at FTX/Alameda, only for SBF to insist that she keep using company (read: customer) money for outside investments as well as loan paybacks; 4) was directed by you-know-who to carry out money gimmicks like stuffing Alameda with ‘Samcoins,’ illiquid in-exchange tokens like FTT and Serum that, in her and Gary Wang’s telling, were created by SBF for the purpose of inflating his firms’ net worth to lenders and investors; 5) hesitated to take the top job at Alameda in 2021 before earning reassurance from SBF that ‘there’s no one better’; 6) was instructed to sign off on Alameda fund withdrawals with nary a clue as to where they were headed; 7) offered insights to Bankman-Fried on how to reduce FTX and Alameda’s gaping liabilities, only to be ignored as he dumped millions, maybe billions of dollars here and there. (By the way, did you know that even though Ellison was putatively CEO of Alameda, taking over at a time when SBF wanted to separate it further from FTX, she actually directly reported to Bankman-Fried?)

Was Sam Bankman-Fried not such a business pro after all, contra Michael Lewis? If Caroline Ellison is to be believed, it certainly sounds as though the crypto megastar was much more risk-happy, much more impulsive, and much less wealthy than he’d ever let on. Ellison and the prosecution also offered fascinating looks inside the psychology driving the boss man: the FTX CEO’s frequent dismissal of underlings’ advice and worries, his blasé approach to dealing with multibillion-dollar budgetary shortfalls, his earnest belief that the best way to make up for such holes was by throwing more money he didn’t have at startup investments that didn’t pan out, his willingness to keep lieutenants in the dark on details pertinent to their jobs, and his insistence on viewing future financial projections in terms of probabilities. This wasn’t exclusive to, say, the chance that FTX could make customers whole if SBF took out another $3 billion to plow into other companies. He even told Ellison that there was a ‘5 percent chance he’d become president someday.’

It’s not as though Ellison now comes off as the Good Samaritan; she did carry out SBF’s directives, misrepresent Alameda’s sturdiness to its financial backers, and take bits of customer money for herself, after all. Still, it’s refreshing to hear from a woman who knew Bankman-Fried much more intimately than many, and who had a front-row seat to the non-FTX end of the ‘Alameda Tree,’ as Ellison characterized it. Anyway, she’ll be back on Wednesday to complete her testimony and her cross-examination, which will likely take the entire day. Almost too perfectly, Tuesday’s proceedings ended on a cliffhanger: On May 7, 2022, the first day of the Terra/Luna fiasco that sent crypto into a deep depression, Ellison and Bankman-Fried collaborated on a Google Doc that covered their ‘worries/questions’ over the FTX-Alameda nexus. ‘Did things get worse?’ Sassoon asked. Caroline Ellison all but mic-dropped: ‘Yes, they did.’

Ref: slate

MediaDownloader.net -> Free Online Video Downloader, Download Any Video From YouTube, VK, Vimeo, Twitter, Twitch, Tumblr, Tiktok, Telegram, TED, Streamable, Soundcloud, Snapchat, Share, Rumble, Reddit, PuhuTV, Pinterest, Periscope, Ok.ru, MxTakatak, Mixcloud, Mashable, LinkedIn, Likee, Kwai, Izlesene, Instagram, Imgur, IMDB, Ifunny, Gaana, Flickr, Febspot, Facebook, ESPN, Douyin, Dailymotion, Buzzfeed, BluTV, Blogger, Bitchute, Bilibili, Bandcamp, Akıllı, 9GAG