Rippling bans former employees who work at competitors like Deel and Workday from its tender offer stock sale

Reading Time: 3 minutesRippling has also told employees who have previously sold shares, particularly if those sales were outside its previous tender offer, that they would not be authorized to sell as many shares this time around.

- the offer was open to both current and former employees

- it involved options, not restricted stock units (the stock that employees had to buy, not the ones granted with restrictions as part of their comp packages)

- employees were eligible to sell up to 25% of their vested equity but the company was including in that count any shares they sold in the previous tender offer

- if an employee sold shares via any method outside of a company tender offer, the company warned it would double count those shares against the 25%

- former employees working for ‘competitors’ were not eligible to participate

When some former employees realized they were being excluded from the sale, a few wrote a scathing letter to Conrad and Rippling’s top lawyer, Vanessa Wu, imploring Rippling to change its mind. Rippling refused to do so.

Why is Rippling excluding ex-employees at competitors?

‘However, tender offer rules require companies to share significant sensitive information, including private company financials, which reasonably are not materials that any company would want in the hands of its competitors. As a result, while most companies exclude former employees entirely, Rippling took the more measured approach of excluding only those former employees who currently work at a list of eight competitors with ambitions to build global HR and payroll products,’ Whithorne said.

To be sure, as a private company, Rippling certainly has the freedom to place restrictions on participation in its stock sales.

Rippling vs Deel, a competitive feud?

Several sources said that Deel is a particularly touchy subject at Rippling. Both companies play into the rivalry with marketing that touts their own tech stack is better than the other.

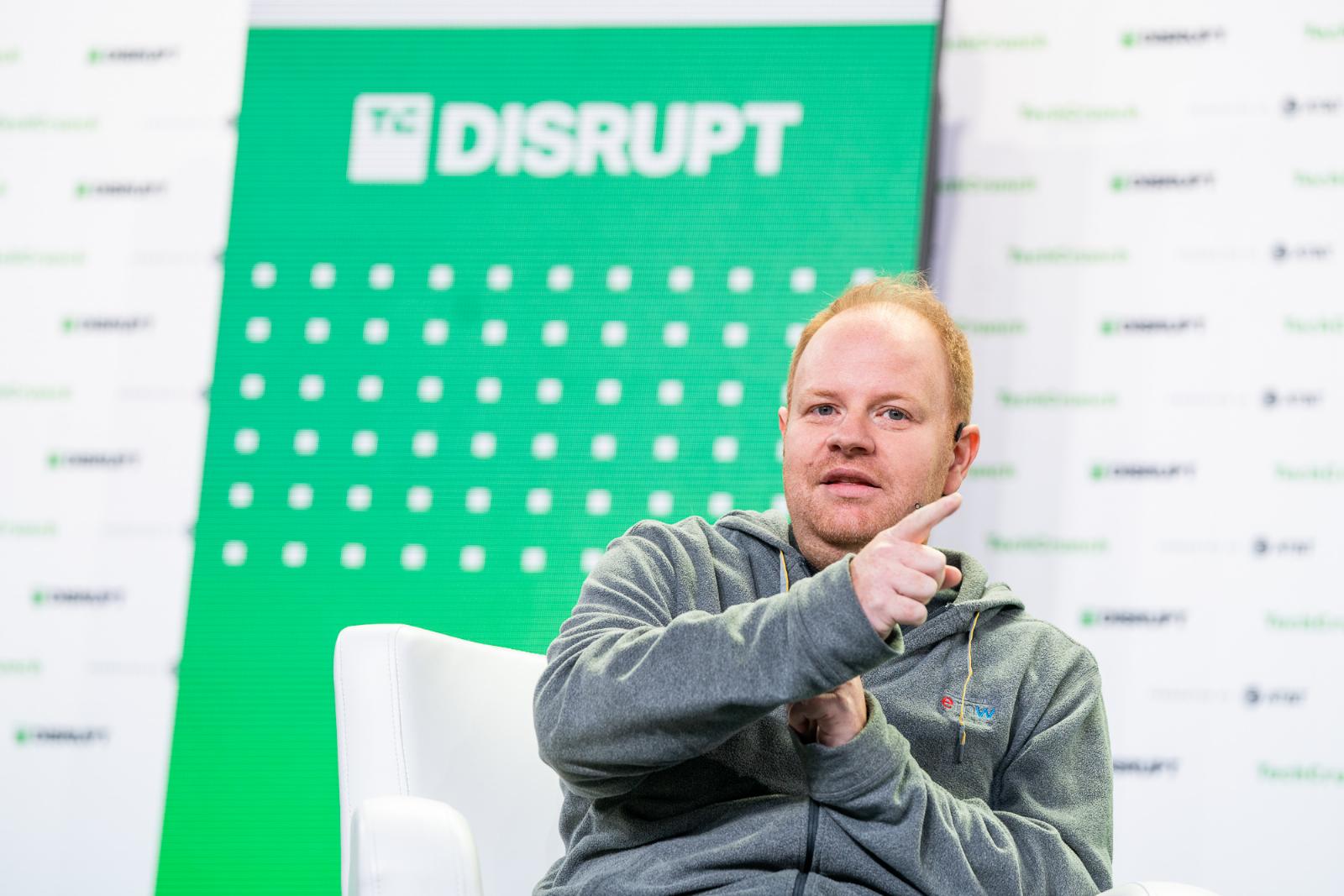

Rippling’s hard-charging CEO Conrad is internally revered as a product genius but is also known as a competitive guy who thrives on rivalry, these sources said.

He built Rippling into a $13.5 billion HR tech success with a product that tightly integrates payroll, benefits, recruiting, and a whole bunch of other services. He also famously built a previous HR tech startup, Zenefits, into one of the fastest-growing startups of its time until it hit a world of trouble that ultimately led to his ouster. Then he founded Rippling, which has also grown like dandelions under his care. During his time at Zenefits, Conrad also had a very public spat with competitor ADP.

Despite the rivalry, Deel was once a customer of Rippling, though it no longer is, sources tell us.

One other thing to note about excluding ex-Rippling employees working at competitors is that, it’s not only about making a profit on their stock. Stock options can be costly. In addition to the price of the stock, employees may face huge tax bills on options they exercise from the paper gains of the value of the stock. Sometimes selling a portion of their stake, if they can, is a way for them to offset such tax bills.

When asked about this, Rippling’s Whithorne said that the company has ‘tried to issue Incentive Stock Options (ISOs) wherever possible (all US employees) which enable employees to defer tax obligations at the time of exercise.’

All employees, current or former, will be able to sell their stock one day, after a lockup period, after the company goes public. But it’s not clear when Rippling will stage an offering. The company isn’t likely in need of more capital at the moment. It just raised that new $200 million infusion, on top of the emergency $500 million it famously raised in 2023 as part of the whole SVB crisis.

For several of the people impacted by this decision, however, it’s not just the money. It’s also about hurt feelings that their former company believes they would do illegal or unethical things and so they are being preemptively left out of a lucrative deal.

‘Your company doesn’t love you, or value you. They are always going to do what is in their best interest. So do what’s in your best interest,’ one source said.

Got a tip about a startup culture you’ve experienced? Contact Julie Bort via email, X/Twitter, or Signal at 970-430-6112.

Ref: techcrunch

MediaDownloader.net -> Free Online Video Downloader, Download Any Video From YouTube, VK, Vimeo, Twitter, Twitch, Tumblr, Tiktok, Telegram, TED, Streamable, Soundcloud, Snapchat, Share, Rumble, Reddit, PuhuTV, Pinterest, Periscope, Ok.ru, MxTakatak, Mixcloud, Mashable, LinkedIn, Likee, Kwai, Izlesene, Instagram, Imgur, IMDB, Ifunny, Gaana, Flickr, Febspot, Facebook, ESPN, Douyin, Dailymotion, Buzzfeed, BluTV, Blogger, Bitchute, Bilibili, Bandcamp, Akıllı, 9GAG