Remember Amazon’s Clubhouse competitor? That’s okay — neither does almost anybody else

Reading Time: 4 minutesAt the height of the COVID-19 health crisis, when many of us — forced by quarantine rules and social distancing guidelines — were locked indoors and away from public spaces, Clubhouse, the audio-focused social platform, grew explosively. A platform where anyone could talk about . . . well, just about anything, Clubhouse drew millions of users seeking a reprieve from pandemic-induced isolation.

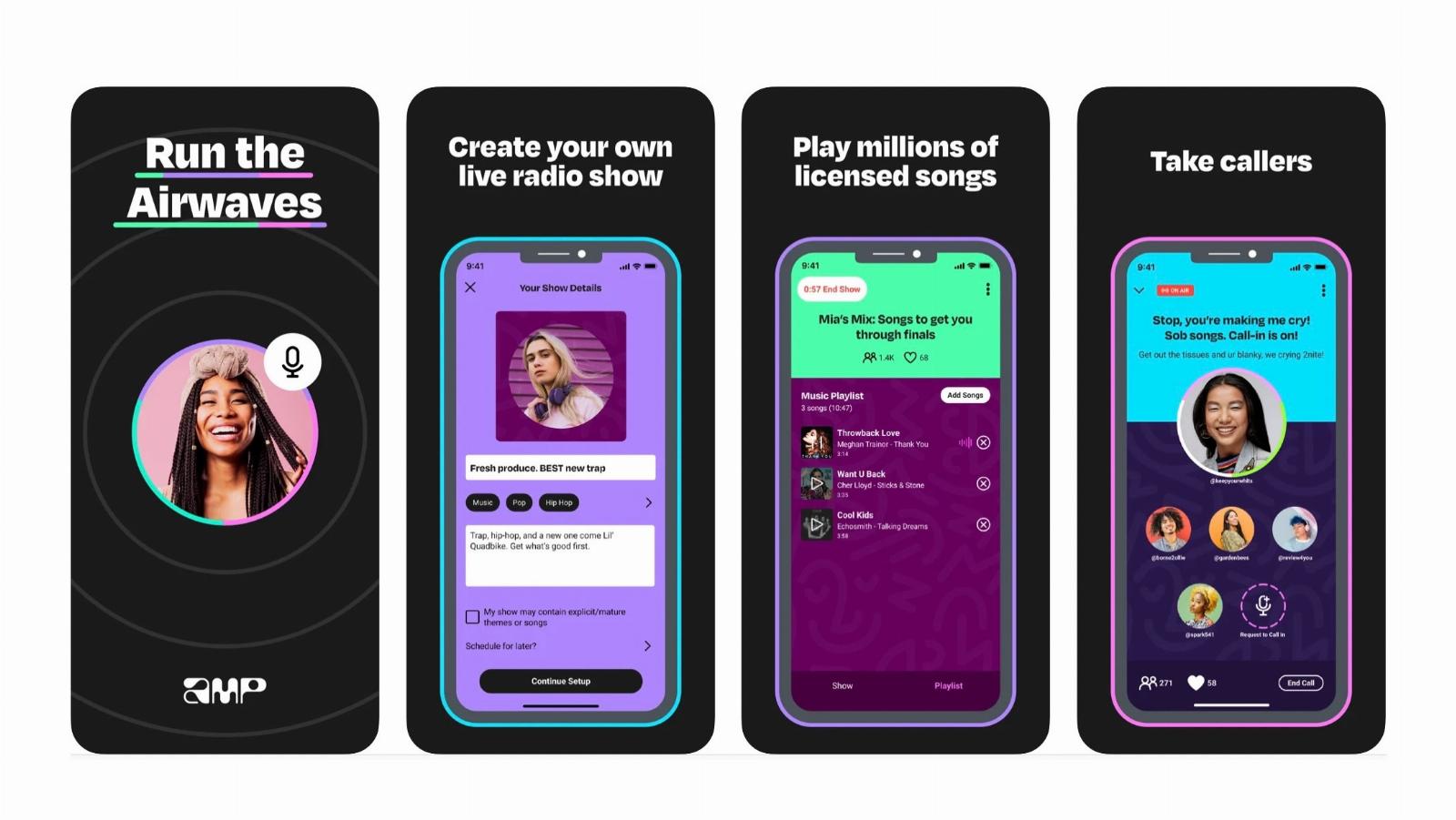

Looking to replicate Clubhouse’s success, tech giants began developing their own audio-focused, radio-like products — see Twitter Spaces, Spotify Live, LinkedIn’s Audio Events and Meta’s Clubhouse competitor. Not one to be left in the dust, Amazon, too, got in the race with Amp, a platform that lets people create live ‘radio shows’ where they can act as DJs by taking callers and playing songs from Amazon’s licensed catalog fee-free.

Point of differentiation

Amp, once known internally as Project Mic, was a belated entry for Amazon into the live audio market. By the time Amp launched in March 2022, Clubhouse had established its dominance, raising funds at a reported valuation of around $4 billion.

Amazon sought to make up for lost ground by strongly differentiating its product from rivals, providing access out the gate to a vast music catalog. Amp users, once signed in with an Amazon account, can play DJ, streaming and chatting about their favorite songs and artists to establish themselves as tastemakers. Or they can use the app to talk about anything else, like sports or pop culture, but do so while also curating a selection of music for their listeners.

As part of the launch in March 2022, Amazon announced a slate of Amp-exclusive shows and programs, including from artists, radio hosts, sportscasters, culture writers and personalities like Nicki Minaj (‘Queen Radio’), Tefi Pessoa and Guy Raz, among others.

Amp launched on iOS, Amazon Alexa devices and the web in beta, only in the U.S. to start. Amazon was targeted at over 1 million monthly active users by the end of 2022, according to internal documents — a tenth of Clubhouse’s user base at its peak.

But Amp never came close to achieving that milestone.

From September 2022 to October 2022, monthly first-time iOS app installs declined precipitously from ~76,000 to ~43,000, internal documents show. And Amp encountered roadblocks on the engagement front, despite its lineup of high-profile content. Between September 2022 and October 2022, the number of hours users spent listening to Amp shows dipped 51% from a peak of around 183,000.

Even without access to internal data, it’s obvious that Amp isn’t the most active of the live audio platforms cohort.

Amp’s flagship programming, like the Zach Sang Show and Nick Cannon’s recently launched morning show, attract only a few dozen to hundreds of listeners per episode after hours on air. The official Amp blog hasn’t been updated since last December. And Amp, which hasn’t officially exited beta, has yet to come to Android despite the website’s promises of an Android client ‘soon.’

Amp’s failure to gain traction reflects both the declining appetite for ‘social audio’ and the tough competition in the market. Analysts blame poor scalability and the lack of monetization options; one of Clubhouse’s most-listened-to streams, an exclusive interview with Adele by Oprah Winfrey, managed to attract only about 40,000 concurrent listeners.

By April 2021, Clubhouse — once a titan in the space it created — had suffered a drop in monthly downloads from 10 million to 900,000 in February 2021, according to Sensor Tower numbers. Last June, Meta ended Live Audio Rooms after initially saying it would incorporate aspects of the experience into Facebook Live. And late last year, Spotify shut down Spotify Live after investing tens of millions in acquiring a startup, Betty Labs, to build the service.

But Amazon isn’t blameless.

Amp’s expansion beyond the U.S. has proceeded at a snail’s pace, perhaps due to the music licensing requirements to bring the platform to other countries. And Amazon has made few attempts to market Amp across its other platforms, particularly its storefront and Alexa devices. Internal data shows that Alexa users made up ~44,000 of the roughly ~100,000 active Amp listeners as of October 2022, a tiny fraction of Alexa’s 500-million-plus-device-strong install base.

In the absence of growth, some of Amp’s headlining creators have left the platform. Halsey, Travis Barker and Big Boi, who Amazon touted as launch partners, haven’t hosted a show on Amp for several months.

In what might have been an effort to stem the bleeding, Amazon late last year launched a fund to reward creators on Amp for ‘creating engaging shows and building loyal audiences.’ But the rollout was light on the details, including how much money Amazon planned to devote to the program, exactly, and came around the same time the company laid off roughly half of Amp’s staff.

It’s not clear where Amp might go from here, given the state of the service as it exists today. But one thing’s for sure: If the ultimate goal was to drive Amazon account sign-ups, Amp fell well short. Documents show that Amp was driving at most single-digit thousands of users to create Amazon accounts each month.

When reached for comment, Amazon characterized all the metrics in this article as ‘inaccurate.’

‘Amp launched in March 2022 in beta, and we’ve seen rapid growth as the service has continued to evolve,’ a spokesperson said via email. ‘We’re continuing to optimize for our customers and are very excited for the product roadmap ahead.’

Ref: techcrunch

MediaDownloader.net -> Free Online Video Downloader, Download Any Video From YouTube, VK, Vimeo, Twitter, Twitch, Tumblr, Tiktok, Telegram, TED, Streamable, Soundcloud, Snapchat, Share, Rumble, Reddit, PuhuTV, Pinterest, Periscope, Ok.ru, MxTakatak, Mixcloud, Mashable, LinkedIn, Likee, Kwai, Izlesene, Instagram, Imgur, IMDB, Ifunny, Gaana, Flickr, Febspot, Facebook, ESPN, Douyin, Dailymotion, Buzzfeed, BluTV, Blogger, Bitchute, Bilibili, Bandcamp, Akıllı, 9GAG