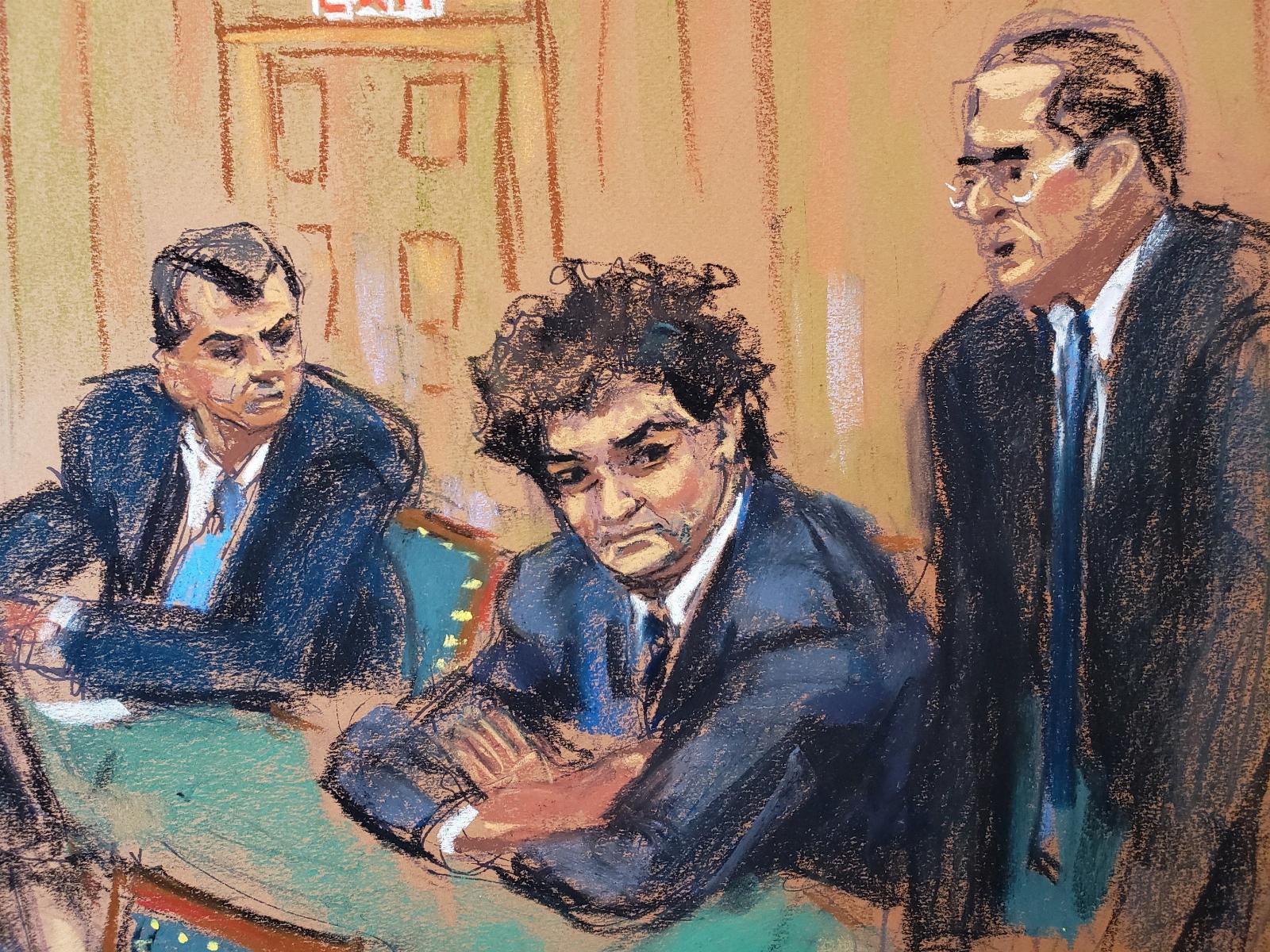

No, Really, What Is Going On With Sam Bankman-Fried’s Baffling Defense?

Reading Time: 7 minutesHis lawyers have confounded observers, pissed off the judge, and dropped few clues about their endgame., Sam Bankman-Fried’s defense is baffling so far. What story do his lawyers have to tell?

This is part of MediaDownloader’s daily coverage of the intricacies and intrigues of the Sam Bankman-Fried trial from the consequential to the absurd. Sign up for the MediaDownloaderst to get our latest updates on the trial and the state of the tech industry—and the rest of the day’s top stories—and support our work when you join MediaDownloader Plus.

Most people shut up after they lawyer up, but not Sam Bankman-Fried. For five months, following the collapse of his crypto exchange FTX in November, the company’s co-founder and former CEO made his case in the court of public opinion, to his advisers’ chagrin. While sifting through the corporate rubble from his Bahamas penthouse, he did live interviews with whoever asked, including Andrew Ross Sorkin at a live New York Times event. After his December arrest on fraud and other federal charges—which led to ankle-monitored confinement at his parents’ Palo Alto residence—Bankman-Fried continued to give his take on what had happened to the billions his company had allegedly misappropriated and ethered, on Substack and to various journalists. He tweeted. He weaved a narrative—not very successfully, mind you—until a federal judge clamped down on his phone and internet use.

I noted back in December that this never-ending gab was remarkably devoid of substance. His main points: that he’s innocent and didn’t know jack. That he was just trying to do the right thing, like he always does. And that his businesses had been fine, actually, and everybody else, including the lawyers, fucked this up. Especially the lawyers!

I’ve often thought back to those early defenses from SBF as I’ve reported from his federal trial in Manhattan this month. He couldn’t have been an easy client to have back then. And I have to wonder what kind of client he is now.

These days, we’re not hearing anything from SBF, although apparently his team is considering having him testify. But something feels amiss with his defense. Among observers of the trial, few of us seem to have a clue about what SBF’s current attorneys—consisting of eight lawyers from the celebrated firm Cohen & Gresser—are doing.

Right now, the prosecution is still presenting its case in the trial. To generalize from my own observations over the past couple of weeks, the cross-examinations (often by Mark S. Cohen and Christian R. Everdell) have rarely, if ever, directly rebutted the government’s severe allegations, which encompass wire fraud, money laundering, and five conspiracy counts related to securities and commodities fraud, among others. More often, the attorneys repeat simple questions on matters the prosecution has already established, before building their way up to potential conclusions that never seem to land (e.g., the government has met with this witness a lot and granted them a deal; this witness couldn’t know what was really going on in this part of the company; SBF was working so hard in his role as the face of FTX). Cohen’s opening arguments presented Bankman-Fried as a business whiz who was just doing what he was allowed to do in an industry (crypto) the government hardly understands: ‘Sam did not steal from anyone. He did not intend to steal from anyone.’ If he commingled customer deposits from FTX through his crypto hedge fund, Alameda Research, even after stepping down as the latter’s CEO? That’s fine, because he remained the majority owner of both companies and was entitled to run them as he saw fit. And he had said Alameda was a market maker on FTX! Really, it was just doing more market making! ‘Nothing wrong with that,’ Cohen told the jury, a phrase he would employ again and again in a soft, avuncular tone.

Cohen & co. do have a most unenviable task, and it’s not just because their famed client appears to have shed all public goodwill, or because so many people think—perhaps prematurely!—that this thing is already over. Remember: SBF has emphasized over and over that the advice of counsel rarely figures into his ‘utilitarian’ reasoning. In a Nov. 16 call with YouTuber Tiffany Fong (who’s also been covering the trial in person), SBF ranted about the lawyers who told him to stop making public statements about the FTX/Alameda bankruptcy. His response to them? ‘I told them to go fuck themselves.’ That very month, one of SBF’s hired counselors left him behind, saying only that ‘conflicts ha[d] arisen.’ Bankman-Fried continued to dis other lawyers who had been in his employ, especially from Sullivan & Cromwell, which had worked for FTX pre-collapse before shepherding its Chapter 11 bankruptcy process; SBF yapped for months afterward about how agreeing to that filing was his ‘biggest’ regret, that his businesses would have been fine had he not filed for bankruptcy, and that Sullivan & Cromwell was basically nothing less than the devil. (SBF’s defense is now prohibited from attacking SullCrom during the federal trial.) Such anti-lawyer sentiment far predates his own legal tangles. In a 2021 tweet, SBF put forth this thought experiment: ‘If you think lawyers are never wrong—what happens when two lawyers disagree with each other?’ The mind of a genius!

Meanwhile, Bankman-Fried’s gab did lead to various legal consequences: federal campaign finance charges based on the transcript of his call with Fong, and revoked bail thanks in part to his leak of ex-girlfriend and Alameda CEO Caroline Ellison’s private writings to the New York Times. I imagine his lawyers also loved it when he ticked off Judge Lewis A. Kaplan by using a VPN during house arrest (he claimed that it was to watch the NFL playoffs). Indeed, after Kaplan sent SBF to jail in August, he repeatedly struck down bids to have the defendant released ahead of the October trial for defense preparation. At least in his parents’ crib in Palo Alto, SBF had reliable internet connections and a flexible trial-prep schedule. Even when his browsing and messaging privileges were curtailed, he was still allowed to access resources useful for his defense. But in Brooklyn’s Metropolitan Detention Center, where power outages are frequent, SBF could use Wi-Fi for only five hours a day. Kaplan did grant the defendant two days a week where he could meet with his lawyers, though I’m sure Cohen’s team would have preferred more time. (I fully believe SBF biographer Michael Lewis when he claims that his subject is more afraid of having no internet than of sitting behind bars.)

It can’t be easy for any lawyer, no matter how skilled, to work with such a troublesome client even before you figure out how to tackle the government’s serious accusations. And make no mistake, SBF appears to have hired some skilled attorneys. As the Wall Street Journal wrote back in January, both Cohen and Everdell have handled some big cases. Everdell is an alum of the Southern District of New York, where he helped prosecute El Chapo; Cohen previously helped hedge fund Wynnefield Capital escape persistent SEC charges. Both also represented Ghislaine Maxwell in her sex-trafficking case and managed to get her down to a 20-year sentence from a potential 35-year maximum. Not a small feat—although Seth Stevenson, who reported on the 2021 Maxwell trial for MediaDownloader, likewise noted that her defense ‘often stumbled and looked overmatched,’ presenting a case that ‘turned out to be shockingly flimsy.’ Keep in mind, Bankman-Fried is facing up to 115 years.

Maxwell and Bankman-Fried are, obviously, accused of very different crimes. But it can be fairly stated that both of them are loathed almost universally, having come under the type of media scrutiny and fire reserved most often for the worst of the worst. Like with Maxwell, the case against SBF appears pretty unambiguous: His high school friend and former colleague (Gary Wang), his ex-girlfriend and former direct report (Ellison), his generous Alameda lender (former BlockFi CEO Zac Prince), and a onetime employee from his hedge fund (Christian Drappi) have all said, under oath, that Bankman-Fried directed FTX and Alameda to use money in ways that he did not appropriately disclose to anyone, whether they were customers, investors, or lenders.

Again, Cohen and Everdell have not denied any of these charges. Their interrogation of the witnesses, rather, focused on the contrasts between them and their former boss in terms of job duties, knowledge of the FTX/Alameda architecture, strategies when dealing with specific cryptocurrencies (whether FTT or Bitcoin), and willingness to cooperate with the government. But the vague gestures have seemed more improvised than planned, not least because the lawyers still do basic things like mess up the pronunciation of former FTX Digital Markets CEO Ryan Salame’s last name. (Sounds like ‘Salem.’) And witnesses themselves are more than willing to push back. One from Prince, in response to published evidence from the defense regarding BlockFi’s assessments of SBF: ‘You’re showing me a credit memo where [my credit risk management team] is saying, ‘We recommend not making this loan,’ and I’m telling you we did not make this loan.’ Or this back-and-forth with former FTX employee Adam Yedidia:

Various outlets covering the trial have made the apparent weaknesses clear from the headlines alone. The Verge, following the trial’s Oct. 4 kickoff: ‘Is Sam Bankman-Fried’s Defense Even Trying to Win?’ CBS Moneywatch, from Thursday: ‘Sam Bankman-Fried’s Lawyer Struggles to Poke Holes in Caroline Ellison’s Testimony.’ A particularly creative one from CoinDesk, on Friday: ‘Things SBF’s Defense Lawyers Should Be Freaking Out About.’ Another one from last week, courtesy of my editor: ‘The Judge Is So Fed Up With Sam Bankman-Fried’s Lawyers.’ (Kaplan is still fed up, in case you were wondering—so much so that the New York Times has referred to this factor as ‘an ominous sign for the defense.’)

It could be the case, as CoinDesk’s Daniel Kuhn has posited, that such pessimistic outlooks on the defense’s performance may stem from ‘the schadenfreude many might feel seeing team SBF squirm.’ Kaplan’s habit of sniping at attorneys when he feels it’s warranted has long been recognized by legal observers. (One example in this trial: ‘I want to express my growing concern about the extent of the entirely unnecessary repetition.’) And he’s most often rapped the knuckles of the defense, though the prosecution has hardly escaped censure. (‘I don’t know what you’re asking.’)

But seriously, what’s the defense lawyers’ endgame? Are they going to blow this in a way that causes SBF to later blame them for botching his case? Do they have a blockbuster document that will turn this whole thing around? Do they have anything to say that goes beyond ‘nothing wrong with that’? As Crystal Kim writes in Axios, one tack Cohen and Everdell may take is to argue that FTX customers’ expectations regarding the service should not be considered in evaluating the allegations. It’s still hard to tell what the overall thrust will resemble. In a recent interview with Time’s Andrew Chow, Lewis related, ‘Mark Cohen said this to me: ‘You get up, you tell one story, and they tell the other story, and the question is which story the jury believes.’ ‘ The prosecution certainly has a story—that Sam Bankman-Fried committed old-fashioned fraud with funny money. Do his lawyers have any story at all?

Ref: slate

MediaDownloader.net -> Free Online Video Downloader, Download Any Video From YouTube, VK, Vimeo, Twitter, Twitch, Tumblr, Tiktok, Telegram, TED, Streamable, Soundcloud, Snapchat, Share, Rumble, Reddit, PuhuTV, Pinterest, Periscope, Ok.ru, MxTakatak, Mixcloud, Mashable, LinkedIn, Likee, Kwai, Izlesene, Instagram, Imgur, IMDB, Ifunny, Gaana, Flickr, Febspot, Facebook, ESPN, Douyin, Dailymotion, Buzzfeed, BluTV, Blogger, Bitchute, Bilibili, Bandcamp, Akıllı, 9GAG