How national interest startups should be thinking about government contracts

Reading Time: 5 minutesNational interest technology can show up in a lot of ways, like in data analysis and cybersecurity, as well as satellites and weapons. Many startups with dual-use applications are increasingly looking at the government as an attractive customer due to its wide range of use cases and the amount of federal dollars available.

And while there are several grant programs (like those offered via the Inflation Reduction Act) that provide nondilutive funding for startups, Rebecca Gevalt, managing partner at Dcode Capital who used to work at the CIA, says she advises companies to go after contracts instead.

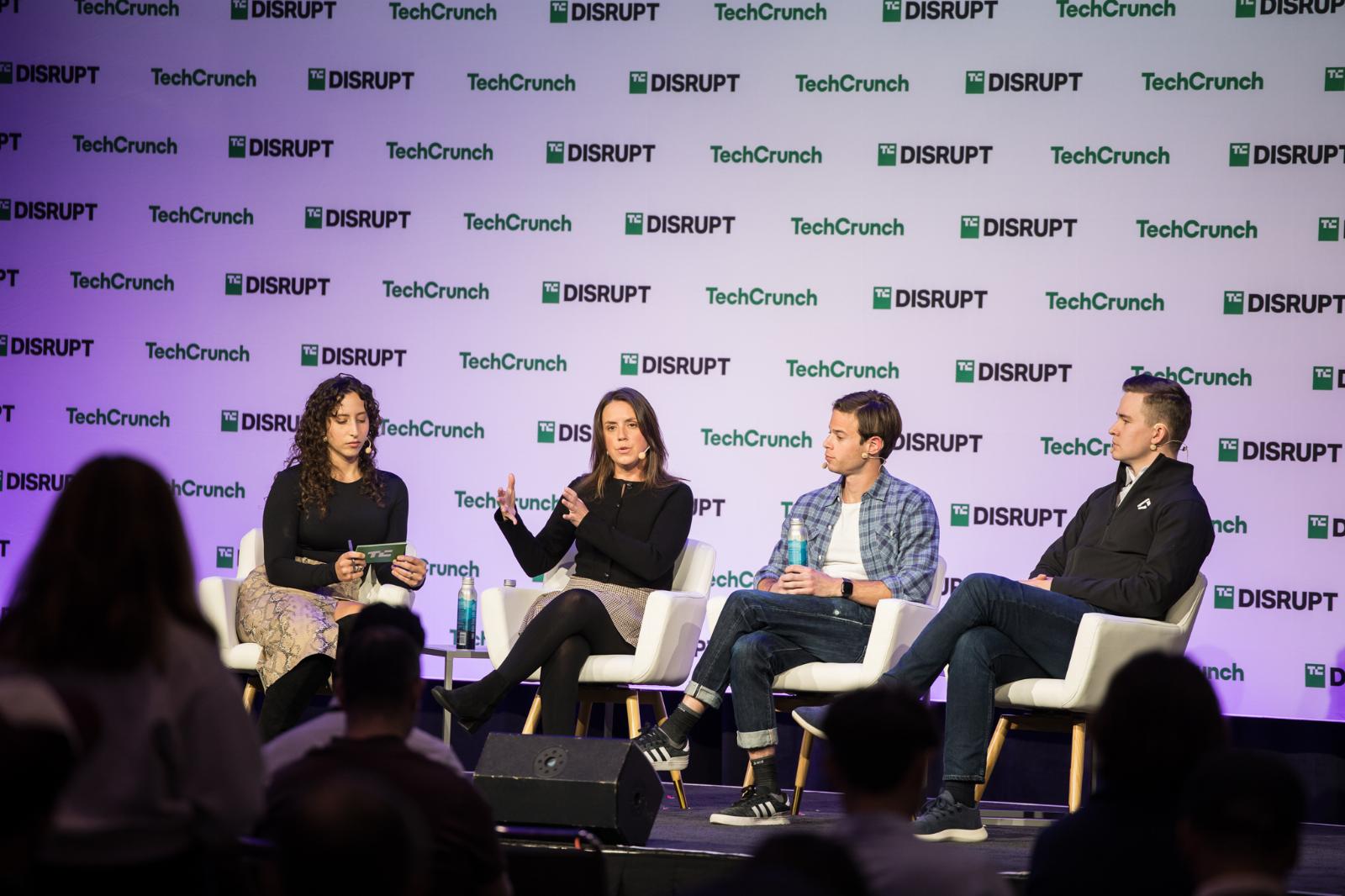

Gevalt spoke alongside Topher Haddad, founder and CEO of satellite imagery startup Albedo, and Kai Kloepfer, founder and CEO of biometric weapons startup Biofire, about the boom in national interest startups and how startups can go about getting a foot in the government door.

The DOD is ‘flush with money’

The goal for startups working with the government should be to get repeatable revenue, not just grant money or other nondilutive funding. One easy target for startups with a national interest use case? The Department of Defense (DOD), which Gevalt says is ‘flush with money.’

The DOD’s budget request for 2025 was close to $850 billion, with $143.2 billion for research, development, testing, and evaluation and then another $167.5 billion set aside for procurement. The agency is actively looking to work with startups developing AI, autonomous systems, quantum computing, and space technologies.

There are a number of entry points for startups, such as the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs through DARPA. And while startups can get a foot in the door through those programs, Gevalt recommends that startups have a partner to guide them from concept and prototyping phases through to commercial contracts.

‘There are strategies to go from that first in the door, R&D dollars for development into more programmatic revenue, and that’s where our advisory firm helps companies, but there’s a number of them in DC that help companies do that,’ she said.

And Gevalt has a point. A 2023 Defense Innovation Board report found that only 16% of DOD SBIR-funded companies made it to commercialization contracts over the last 10 years.

But it’s not all defense

‘I think a lot of times people can fall into the trap of thinking, if I want to sell to the government, then it has to be related to defense tech, and I have to be involved in drones, missiles, things like that. And that’s fundamentally not the case,’ Gevalt said.

She says Dcode is heavily focused on investing in startups that handle and analyze data, as well as ones that offer cybersecurity solutions.

‘By law, the government cannot delete any of its data, so it’s going to be a continually growing problem for them to manage it and to drive insights out of it,’ Gevalt said. ‘And then, from a cybersecurity perspective, they get hacked rather frequently, so trying to get them access to the best tools.’

Put your blinders up to politics

In the lead-up to the U.S. election, should startups be coming up with contingency plans for different presidential candidates? Gevalt and Albedo’s Haddad say that’s not exactly necessary.

‘Across administrations, you are going to have people interested in data, tools, cybersecurity, the latest in AI,’ Gevalt said. ‘Where the dollars flow change, how big the government will be could change. But I fundamentally believe whether or not the government grows or gets smaller, there’s going to be a requirement for them to upgrade their systems from the year 2000.’

Haddad noted that Albedo is in ‘wait-and-see’ mode, as it’s expecting some effects. But not enough to have a Plan A and Plan B for different candidates.

‘Generally, space is a big priority, and I don’t think that will change,’ Haddad said. ‘Maybe it will change a bit of the business development in terms of how we focus on different agencies or departments.’

Gevalt said that the best way to remain unaffected by changing administrations is to seek out relationships with nonpolitical appointments.

‘As you’re developing your federal go-to-market motion, you don’t typically want to talk to the politicals,’ she said. ‘You want to talk to the people who are doing the jobs day in, day out, regardless of who’s in the administration, because those are the people who are going to buy your products.’

Made in the USA

Gevalt said that for government, contracting with startups that are based in and producing products in the U.S. is preferred — but more so for software than hardware.

‘If there are certain people on your team doing certain work from certain countries, then it makes it very hard to do sales into the government, at least into the DOD and into some intelligence community agencies,’ she said.

Both Albedo and Biofire are based in the U.S., with manufacturing facilities in Colorado. Kloepfer noted that building in the U.S. was important for Biofire because of the nature of its business.

‘We are quite strongly regulated by the Department of Commerce with respect to export controls. … [T]he U.S. is excited about keeping its weapons technology inside the U.S.,’ he said, noting that Biofire would likely need special approval to contract foreign manufacturers.

He added that investors also like to see onshored manufacturing because it helps with quality control and scaling.

‘For the early stage that we’re at, it’s how fast can we iterate? How fast can we improve?’ Kloepfer said. ‘And doing that at our current headquarters facility … is orders of magnitude easier than iterating with some sort of overseas vendor, if that’s even possible.’

Finding product-market fit in government

Gevalt says that her firm often sees early-stage companies hire a salesperson or lobbyist out the gate when trying to secure contracts with the federal government. She advises instead that startups first figure out which agencies have a need for their technology using available data from sites like Bloomberg Government (BGov), GovTribe, and GovWin IQ.

‘When the government says they want to go buy something, they have to put it out publicly, unless it’s a classified thing,’ she said. ‘So … you can sift through that data. And if you know whoever your competitor is, and you know they’re selling to the government, you can … see what contracts have they won? In what offices have they won them? Are they working with partners like Deloitte or Booz Allen?’

That’s also true for AI startups looking to work with government.

The key mindset is to be strategic and tactical, Gevalt says, noting that startups should look at the government’s overarching strategy documents regarding AI and then tactically seek out offices that are actively leveraging AI technologies.

‘You have a lot of people who’ve been in the government for a very long time, and so they know conceptually what AI is, but a lot of the data architecture that they have won’t actually facilitate the use of an AI product on whatever datasets they’re working on anyway,’ Gevalt said. ‘So … strategically, you can see the Biden administration right now wants to leverage AI in this way. But tactically, how are the agencies actually doing it? … How are they buying it? Are they buying it through a partner?’

Ref: techcrunch

MediaDownloader.net -> Free Online Video Downloader, Download Any Video From YouTube, VK, Vimeo, Twitter, Twitch, Tumblr, Tiktok, Telegram, TED, Streamable, Soundcloud, Snapchat, Share, Rumble, Reddit, PuhuTV, Pinterest, Periscope, Ok.ru, MxTakatak, Mixcloud, Mashable, LinkedIn, Likee, Kwai, Izlesene, Instagram, Imgur, IMDB, Ifunny, Gaana, Flickr, Febspot, Facebook, ESPN, Douyin, Dailymotion, Buzzfeed, BluTV, Blogger, Bitchute, Bilibili, Bandcamp, Akıllı, 9GAG