Forme Financial launches out of beta as Earned to help physicians manage wealth

Reading Time: 3 minutesForme Financial, a wealth management platform for physicians, is emerging from beta with a new name and $12 million in Series A funding.

Now called Earned, the New York-based company provides a ‘comprehensive wealth system’ focused on the needs of physicians, which John Clendening, co-founder and CEO of Earned, said were unique and often complex, depending on the person’s career stage.

Physicians spend around 10 extra years in educational training, so that reduces their career in terms of reaching retirement, Clendening explained. They exit college, often with an average of $300,000 in debt, and at the same time, get a 5x to 15x increase in their income following their residency or fellowship program.

In addition, something he noticed in the last five years is a change in the way physicians think about job opportunities. For example, thinking more about what it means financially to take a new job, particularly if they are going from owning a practice to working for someone else.

‘That means a significant amount of financial complexity,’ Clendening said. ‘Physicians work an average of 70 hours a week and are never trained in financial topics. Despite being in a very upper echelon of wage earners, one in four physicians retired in the last couple of years with $1 million or less in net worth. When they want to get some help for this, they face a system that is super one-size-fits-all. The so-called specialists or experts are totally silent and none of them talk to one another.’

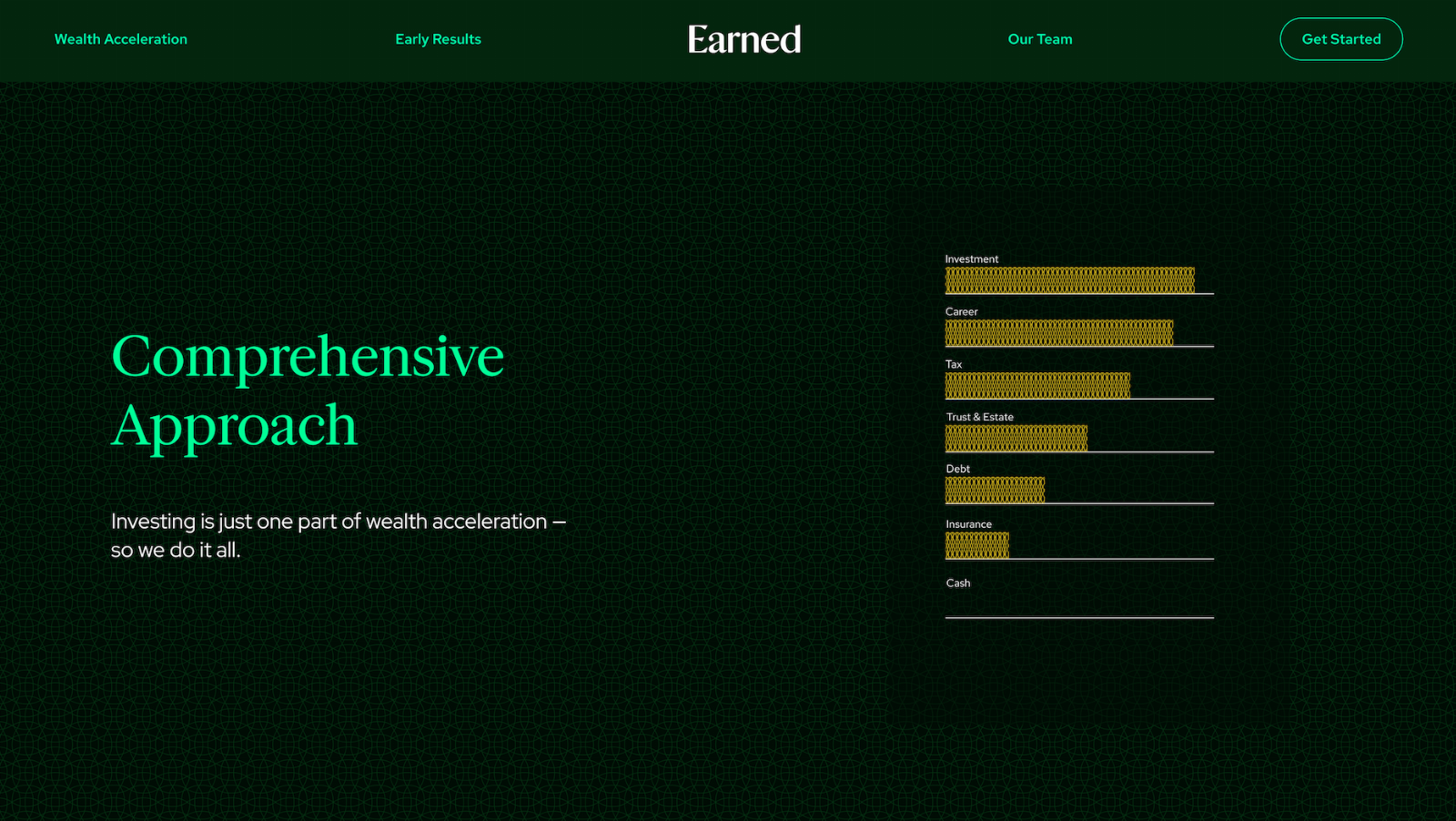

Instead, Earned’s ‘proprietary wealth engine’ combines a physician’s career journey with predictive technology to create data-driven financial recommendations across offerings like estate planning, taxes, debt management, insurance and investments. The company’s Certified Financial Planners are also able to help physicians understand the implications of important career decisions, including buying into private practice or selecting from multiple job offers.

The company’s vision always included a name change at the Series A stage, but Clendening also explained that ‘Earned’ had more resonance as it related to ‘the mindset physicians who see themselves as people who are really invested a lot in their career as their No. 1 asset.’

Earned makes money in a couple of ways: charging customers a fee based on assets under management and earning a commission, for example, when customers choose to purchase items like insurance.

Since its beta launch in May 2022, Earned is working with more than 100 physicians in 24 states with 71% of users logging in weekly. They have also saved an average of $77,000 in taxes, Clendening said. He declined to disclose details about the company’s revenue.

Other banks and fintechs offer banking and other financial services for physicians; for example, Panacea Financial, PhysicianBanks.com and Laurel Road. However, Clendening said most just offer lending products and don’t look at the entire perspective of physicians.

‘There are some edge competitors that have certain aspects of what we do, it’s just not enough to have the sort of impact that we’re talking about,’ Clendening said. ‘We are purpose-built exclusively for physicians, inclusive of career advisory, and alongside that, a full-stack approach. Think about like a toolbox: We have every single tool in the toolbox that’s needed to optimize their financial life. We stand alone in that regard. We are also leveraging deep tech to reliably deliver what we’re optimizing financially.’

In addition to the name change, the company also announced $12 million Series A funding, led by Hudson Structured Capital Management and Breyer Capital, with participation from Juxtapose. This latest round brings Earned’s total funding to $18 million since it started serving customers in 2022.

With this new round of funding, Clendening intends to invest in hiring and technology to add more tools and features to its wealth engine with a goal of becoming what he called ‘a one-stop shop for physicians.’ It is also focusing on customer acquisition because each physician has a unique career journey that helps Earned get more examples of what’s going on in someone’s financial life, he said.

Meanwhile, Clendening estimates the wealth management for physician space is around $13 billion in addressable market annually, and is still ‘wide open in terms of competition for this space.’ He is also considering expanding to other high-earning healthcare professionals, like dentists, and to physician families.

‘Job one is to continue the work that we’ve done inside the physician vertical,’ Clendening said. ‘We will go deeper and deeper inside the physician profession with a goal to, over time, become the only place that a physician would go for any sort of advisory relative to their financial life.’

Reference: https://techcrunch.com/2023/04/06/earned-physician-wealth-management-fintech/

Ref: techcrunch

MediaDownloader.net -> Free Online Video Downloader, Download Any Video From YouTube, VK, Vimeo, Twitter, Twitch, Tumblr, Tiktok, Telegram, TED, Streamable, Soundcloud, Snapchat, Share, Rumble, Reddit, PuhuTV, Pinterest, Periscope, Ok.ru, MxTakatak, Mixcloud, Mashable, LinkedIn, Likee, Kwai, Izlesene, Instagram, Imgur, IMDB, Ifunny, Gaana, Flickr, Febspot, Facebook, ESPN, Douyin, Dailymotion, Buzzfeed, BluTV, Blogger, Bitchute, Bilibili, Bandcamp, Akıllı, 9GAG