Astera Labs IPO will reveal how much investors want in on AI

Reading Time: 3 minutesWhile the technology world breathlessly awaits Reddit’s public debut, another company you might never have heard of is about to go public: Astera Labs. And it may be a more important test of investors’ returning appetite for tech IPOs.

Astera this week announced in a public filing that it’s public debut would be bigger than it initially planned in every way: It will sell more shares — 19.8 million vs. the previous plan of 17.8 million — and at a higher price, expecting to sell at $32 to $34 per share, vs. the previous $27 to $30 range. Astera expects to raise $517.6 million at the middle of its raised range, it said, up from $392.4 million. IPO watchers expect it to debut this week.

While Reddit’s IPO could do well from investors looking to buy a well-known social media company that has an interesting, burgeoning AI data business, Astera Labs is an AI hardware story. And no, it’s not taking on Nvidia, the American chip giant that created the world’s most in-demand AI chip.

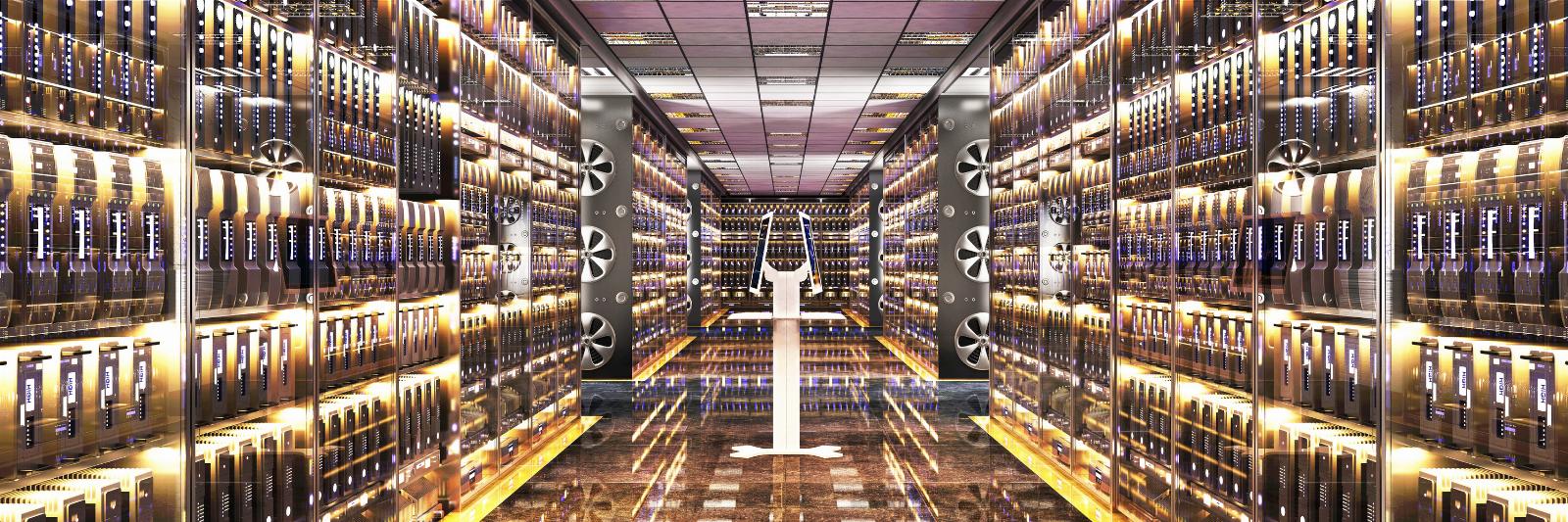

Astera Labs makes connectivity hardware for cloud computing data centers. Because AI requires massive amounts of data moving into, out of and around data centers, Astera has seen recent its revenues bloom. After generating $79.9 million in 2022, revenue swelled 45% in 2023 to $115.8 million.

With 271 mentions of ‘AI’ in its most recent SEC filing, the company is working hard to convince investors that it’s part of the larger artificial intelligence boom.

Then again, while the company does have an AI story to tell, its rapid recent growth and demonstrated early profitability could be the key drivers to its public-market investor interest.

Companies can grow and make money at the same time

In startup-land, growth and losses often walk hand-in-hand. Startups raise capital from private-market investors, investing the funds into their operations to expand headcount so that they can build, and sell more quickly. Often by the time that a startup reaches the required scale to file for a public offering, it is still unprofitable and not likely to start generating adjusted profits, let alone profit according to more stringent accounting standards, in the near future

Up until the fourth quarter of 2023, Astera Labs appeared to be just that sort of company. It’s business grew rapidly last year, with sticky losses to match.

On its 2022 $79.9 million in revenue, it posted a net loss of $58.3 million; on its 2023 $115.8 million in revenue, net loss tallied $26.3 million. So, on an annual basis, this is far from the kind of profitable company IPO experts say this harsh market requires. Even when the company removed the non-cash costs of paying its workers partially in shares, the company’s adjusted profits were still negative in 2023.

But when we dig in, its financial success becomes more nuanced. In the third quarter of 2023, Astera Labs’ revenue began growing dramatically: from $10.7 million in Q2 2023 to $36.9 million in Q3, and $50.5 million in Q4.

And while that spike in growth is impressive on its own, the company’s profitability picture has also radically improved as 2023 came to a close. After posting a net loss of $20.0 million in Q2 2023, net loss evaporated to a mere $3.1 million in Q3 2023.

And for Q4, Astera Labs swung to a profit: $14.3 million worth of net income.

Einhorn warned that the company’s Q4 2023 results may not augur the company’s new normal. ‘One of the challenges for companies like this,’ he explained, ‘is that you tend to have a lot of customer concentration and customer buying patterns can be very lumpy.’ Good recent quarters do not always imply similar future quarters. Another weakness: in 2023, its biggest three customers represented about 70% of its revenue, Astera disclosed.

Putting it all together: Astera Labs has caught a wave thanks to AI data center spending. Its resulting financial glow-up is impressive, and helps explain why its IPO is is set to occur at a valuation of around $5.2 billion, a healthy lift from of its final private-market price of $3.15 billion.

If the company is able to attract a strong following after its first day of trading, it could wedge the IPO door open for other businesses seeing newfound growth as a by-product of AI. And perhaps that will be enough for more technology offerings to sneak out this year.

Reference: https://techcrunch.com/2024/03/19/will-astera-labs-ipo-attract-ai-investors/

Ref: techcrunch

MediaDownloader.net -> Free Online Video Downloader, Download Any Video From YouTube, VK, Vimeo, Twitter, Twitch, Tumblr, Tiktok, Telegram, TED, Streamable, Soundcloud, Snapchat, Share, Rumble, Reddit, PuhuTV, Pinterest, Periscope, Ok.ru, MxTakatak, Mixcloud, Mashable, LinkedIn, Likee, Kwai, Izlesene, Instagram, Imgur, IMDB, Ifunny, Gaana, Flickr, Febspot, Facebook, ESPN, Douyin, Dailymotion, Buzzfeed, BluTV, Blogger, Bitchute, Bilibili, Bandcamp, Akıllı, 9GAG